Full Year 2024 Results and Thoughts

Believe in the weight, not the votes.

Dear Investors,

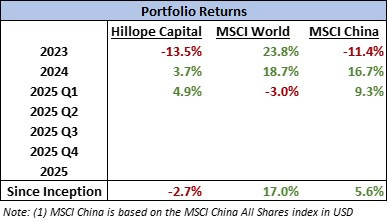

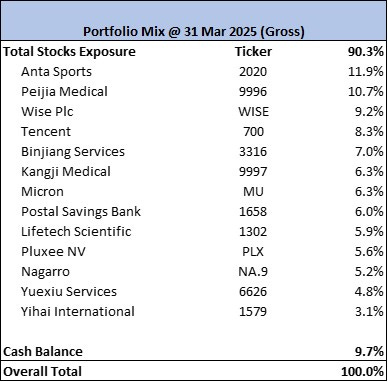

Below is the return summary for 2024 and Q1 2025 (including dividends), as well as the breakdown of top holdings:

Thoughts and Musings

Berkshire Hathaway Annual Meeting 2025 - around 1965, a then little known man from Omaha called Warren Buffett made one of his early mistakes in investing - instead of selling his shares in a dying textile business in New England, he reversed course, in an irrational move, to buy as many shares as he can because of a broken promise when the seller tried to low-ball the agreed transaction price by 1/8 of a dollar ($11.50 → $11.375). In 1965, as with so many great stories that began humbly and inconsequentially, Warren Buffett took over the company known as Berkshire Hathaway. Fast forward 60 years, Buffett (together with his partner Charlie Munger) compounded the share price by … hold your breath … 55,000 times. Every $100 invested then (worth about $1,000 in today’s terms) would be worth $5.5 million today! Caveat: only if you hold on to the stocks for 60 years.

This year Buffett announced his retirement as CEO, to a standing ovation lasting for more than 10 minutes. As I was watching the video from the comfort of my home (I wish I was there in person to feel the energy), I can’t help but felt an palpable sense of awe. What a life! I can’t imagine the sense of satisfaction that Warren must have felt at that moment. What’s more amazing is that the standing ovation wasn’t about his wealth or status at all, it is about his devotion to the craft of investing, the way he treats his shareholders and business associates, and most importantly, the unselfish sharing of his wisdoms demonstrated consistently throughout his entire life. People applaud because they admire and respect him, and truly want to thank him. I want to take a moment here to also thank Mr. Buffett and all his teachings not just on investing, but on how live a good life in general. I do feel a sense of pity that we can no longer see him again on stage during Berkshire’s annual meetings, but I am sure value investors in a century from now will be so envious of our generation, having lived in an era where the greatest investor of all time lives and breathes.

My Framework Towards Selling

In this letter, I want to share more about how I think about selling stocks. To many value investors (myself included), I found that the decision making process and psychological nuances are often more complicated in selling than buying. Many value investors including Buffett always preach about “I buy something to hold forever”, while Mohnish Pabrai has elucidated his painful examples in selling winners too early (think Ferrari, Frontline).

To me, the most fundamental (and often difficult) question to figure out is whether the moat of the company has been widening or has structurally deteriorated. Such an assessment needs to be objective (minimise the endowment bias), differentiate between endogenous vs. exogenous factors (company-specific issue vs. industry-wide issue), and has to be evaluated over a period of time (at least 1-2 years). There is often no easy answer to this question (if there is, there won’t be so many sell mistakes in investing), and it all boils down to some combination of intuition, pattern recognition and how much you truly understand the business. Unless there is a clear and major change in the economic prospects of the business (e.g., death of the founder, loss of a major customer, major acquisition gone wrong, etc.), the competitive position of a company usually doesn’t change over 1-2 quarters. After having studied the company and determined if the competitive position of the company has been improving, the usual thought process I’ll like to go through is to ask myself the following question:

“With all the information that I now know and assuming I haven’t owned the stock, would I still use the equivalent amount of cash to buy the stock at the prevailing price?”

Asking such a question helps to frame my mind against any biases and consider all the alternative choices available (the good old economics concept of opportunity cost). One note of caution that many value investors have spoke about is the mistake of selling too early. In general, in a situation where the company’s moat is widening, unless the company’s valuation goes ridiculously high (typically in a frenzy bull market), we should always err on the side of inaction rather than action, to avoid what Peter Lynch’s warning of “cutting the flowers and watering the weeds”. The last gateway in my selling framework is to consider the opportunity cost. As Charlie Munger so often alluded to, opportunity cost in investing means to always ask the hypothetical question in relation to the opportunity set available to you within your circle of competence. E.g., if I sell this stock now, do I have an obvious place to deploy the unlocked cash? If not, will cash or treasuries be a better place to park the cash?

Investors often fall into the anchor bias trap, whereby they have a mental anchor to the entry price they paid. The arbitrary anchoring of the entry price, which also manifest itself in loss aversion (the reluctance to sell before a depressed stock ‘recover’ back to the entry price), acts in a similar way for some investors with the urge to ‘cash-in’ the gains after the stock has doubled or tripled. To counter this, I found it useful to take a step back and mentally condition my mindset in two ways before even analyzing what is happening to the stock. The first is an internal reset to try and forget the entry price that you have paid for the stock. The second, which is an external factor, is to do what Howard Marks calls “taking the market’s temperature”. You can read the full memo here. Taking the temperature means to observe and collect various data points on where the market psychology stands in relation to the pendulum of optimism and pessimism. Although Buffett always talks about how little attention he pays to macro events, I feel that this second framing of mindset is crucially important, as it helps to set the overall tone between euphoria vs. depression, which will better inform the overall tendency between selling vs. buying

In summary, my framework for selling a stock can be condensed into the following easy-to-read flowchart diagram with a 5-step process:

With the above framework in mind, I want to confess a couple of mistakes on selling - Beststudy, 3SBio and Tencent.

Beststudy Education (HK: 3978) was a stock that I first started buying back in 2020, prior to starting Hillope Capital. The company mainly offers after school tutoring and talent program classes in China. During 2021, the entire sector got decimated during the infamous regulatory crackdown called “双减” - essentially a nationwide policy to reduce stress on families (psychologically and financially) due to excessive homework and after school tutoring. Over a 3-4 months time, the company’s share price (along with other similar listed companies such as TAL, New Oriental, Scholar Education) went down almost 95% as investors panicked and fled the entire sector. I was caught in the turmoil and didn’t act in the first instance when the news broke. As time dragged on, it became clear that the government is hell-bent on pushing through and enforcing this draconian regulation despite the criticism and public backlash. I decided to take the loss of c.80% and sold the stock because whatever residual value that was left was better than zero. Fast forward 3 years, the stock is now up c.30x from its bottom (c.15x from where I sold), as the government tacitly reverses its stance on the sector. Was I wrong on the sell decision? Looking back, I believed the decision was justified. If I were not to sell the position, it would have been a bet against the CCP, a conviction in the fact that parents will continue to send their kids for ‘illegal’ tuitions in its relentless pursue to get their kids ahead of others (hence rendering the Double Reduction’s original intent totally futile), and also believe in Beststudy management team’s turnaround capability to navigate such a once-in-a-lifetime crisis. Taken altogether and knowing what I knew at that time, it would still be a wiser decision to sell. Having said that, what was indeed a mistake for me was in not continuing to follow up with the industry and company’s progress after I have sold it. Had I continue to monitor the situation, feel the minor shifts in sentiments and from the ground, I may have been able to buy back the stock at a depressed price. As the saying goes, hindsight is always 20/20.

3SBio (HK: 1530) is a biotech company in China that does R&D, manufacturing and sale of various pharmaceutical products targeting a range of indications from oncology, hepatology and auto-immune diseases. Its key product (Tpiao) treats a condition called thrombocytopenia, which is a lack of platelets in the blood, and generates a sales of RMB 5bn (>50% of total sales). After holding the stock for almost 3 years, I decided to sell the stock in 2023 and I wrote about this in my Q3 2023 letters. In that letter I wrote, “ … if you have determined that the reason for selling is not that the price has reached above its intrinsic value, but is because the company is outside of my CoC in the first place, then it wouldn’t matter. Those profits, if it ever materialize in the future, are not made for you anyway.” As I am writing this letter (May 2025), the profits have indeed materialised, as the Company’s share price exploded from c.$7 in Feb 2025 to c.$20 today. This was due to a major announcement from Pfizer to license-out one of its R&D candidates - SSGJ-707, a bispecific antibody targeting PD-1 (a protein that regulates immune responses) and VEGF (a protein in stimulating the formation of new blood vessels), currently undergoing several clinical trials in China for non-small cell lung cancer, metastatic colorectal cancer, and gynecological tumors. Pfizer has agreed an upfront payment of US$1.25 billion and 3SBio is eligible to receive further milestone payments of up to US$4.8 billion. Such a blockbuster license-out deal is rare for a Chinese pharmaceutial company. Although this news was a surprise to me (and many industry observers), my decision to sell was justified because it would still be outside my circle of competence to be able to figure out the potential of this arcanely named candidate SSGJ-707.

Tencent (HK:700) is a stock that I was familiar with and held for sometime. In Mar 2024, for no apparent reason other than out of fear (it was a gruelling 3 year bear market for China stocks) and wanting to buy Yihai International and Jiumaojiu but not with more cash (I was a bit worried about over-exposure to China), I trimmed and sold 1/3 of my holdings in Tencent at a price of HK$ 272. That proves to be a mistake given that the moat of Tencent was intact, and the valuation was low (would definitely buy the stock at such a depressed price). There is nobody to blame but myself, and to compound that mistake, some of the cash proceeds from selling Tencent was partially plouged into Jiumaojiu was eventually sold at a loss of another 40% (more about that below).

Key Portfolio Updates

During the past 9 months up to Q1 2025, I sold all my holdings in Jiumaojiu and China Education Group, and trimmed down my holdings Kangji Medical and PSBC, in order to add to Anta Sports and Yuexiu Service, while initiating new positions in Wise Plc and Pluxee NV. With the above selling framework in mind, I shall explain my actions here in more details:

Jiumaojiu (HK:9922) - I wrote about this company in my last letter, I initiated a small position beginning in Q1 2024 as the valuation of the company came down a lot (from the peak of c.$35 in Q1 2021 to $5 in Q1 2024) due to what I thought were temporary headwinds as the management navigated a fiercely competitive environment coupled with weak consumer spending in China. However, after the 2024 results were released, it became clear that the challenges facing the company are immense and the new brands meant to provide new growth pillars didn’t materialise. As I always had an aversion to the F&B retail industry and seeing that Haidilao instead was doing much better, this was a signal that the thesis may be broken. Once it became clear that the industry headwinds were too severe and any remaining moat was illusionary, I decided to sell. A side note: with such an immense industry challenge, Haidilao was still able to deliver an industry-beating performance demonstrates how well the company is being run. Haidilao has again proven its magic (more on this and Yihai International in the next letter).

China Education Group (HK:839) - After holding for almost 4 years, and having analyzed the sector and all its companies listed in HK, I have came to a conclusion that the regulatory headwinds are too severe with no hint of improvements in sight, and that the steadily increasing dividend growth story may not be a straightforward case. The longer the delay in any progress towards government granting approval to convert schools to ‘for-profit’, the less conviction I have in the belief that the government will eventually open up this industry. Moreover, the recent huge impairment loss in goodwill and intangible assets (wiping out almost 70% of FY2024’s net profits) relating to prior acquisitions, meant that the overall industry prospects are dim as student enrolments and the ability to increase fees are not as easy as previously thought. Though such impairment losses do not impact cashflows, it does destroy the value of the business since it meant that past acquisitions were overpaid. All these imply that the steady high dividend yield ‘fixed income’ thesis may be broken - indeed, the latest FY2024 dividend has dropped 24% to RMB10.28c per share, while no interim dividend was declared for FY2025 (vs. RMB18.77c in FY2024), all of which have hammered the share price tremendously. Having said that, I still believe that CEG is the most well run company among the higher education stocks in China, but until the government shows more tangible actions towards opening up the industry, it should remain ‘uninvestable’ in my view.

That’s all for now. I shall write about the buy decisions on Wise Plc and Pluxee NV in my next letter on H1 2025 results, due around Sept 2025. Thank you for your attention. Lastly, as usual, I will end this post with the following quote:

"It is obvious that the performance of a stock last year or last month is no reason, per se, to either own it or to not own it now. It is obvious that an inability to "get even" in a security that has declined is of no importance. It is obvious that the inner warm glow that results from having held a winner last year is of no importance in making a decision as to whether it belongs in an optimum portfolio this year."