H1 2024 Results and Thoughts

People call it Value Investing, I call it Company Investing

Dear Investors,

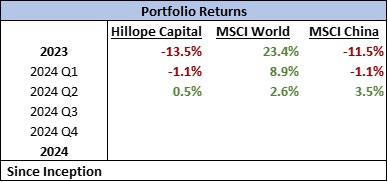

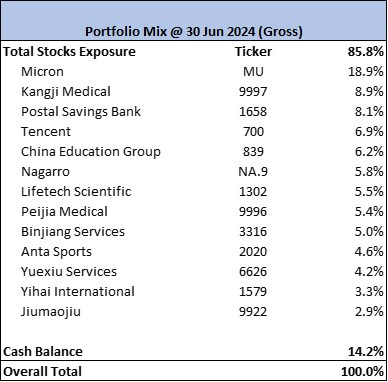

Below is the return summary for H1 2024 (including dividends), as well as the breakdown of top holdings:

Key Portfolio Updates

During the first half of 2024, there is a more than usual level of activity on the portfolio. I sold all my holdings in Alibaba, AK Medical, Xtep International, trimmed my positions in Tencent, and added to Nagarro and Kangji Medical. Finally two new companies were initiated in the portfolio - Yihai International and Jiumaojiu.

As continued from my previous post, below are the updates on FY2023 for my the portfolio companies:

Micron (NASDAQ:MU) - For the six months ending Feb 2024, Micron’s revenue grew by 36% while operating losses narrowed by 61% (from USD 2.4bn loss in H1 FY23 to USD 0.9bn loss in H1 FY24). In fact, operating profit has turned positive again in Q2 FY24 after 5 consecutive quarters in the red. As recent as Dec 2023, clear signs were emerging that the semicon memory sector has finally bottomed with NAND and DRAM prices both forecasted to grow by double digit in the next 3-6 months. Such a boom and bust cycle is well expected in the semicon memory sector which has been replayed a number of times over the past 20 years, but what surprised me this time round was the explosive growth in the high-bandwith memory (HBM) sub-segment driven by the ongoing AI craze (with Nvidia at the core of all the hype). SK Hynix was the first mover in terms of commercially launching the HBM3 but Micron quickly caught up with the competition for the latest HBM3e chip, which it claims to consume 30% less power than its competitors and is will be mass produced and shipped with Nvidia’s H200 AI GPU (critical in all Gen AI applications) in Q2 2024. Furthermore, Nvidia’s most advanced next gen Blackwell chips have seen orders soaring and will also be using Micron’s HBM3e chips. Both SK and Micron’s HBM3 orders have been sold out for 2024 and 2025 due to insatiable demand for AI chips. Samsung, meanwhile, has lagged its peers and latest reports suggest it has failed Nvidia's tests on its HBM3e memory stacks due to excessive heat and power consumption issues. If true and sustained, this may present a window for both SK and Micron to quickly capture market share in the surging AI segment. It is surprising to see how quickly market sentiments turn and narrative change from “it’s the worst memory chip slump in history” to “we are seeing a structural shift for AI chips”, which obviously investors are now rushing to cash in - Micron’s Q1 share price is up 43% and 1 year price has almost doubled.

I first encountered Micron after listening to investors like Mohnish Pabrai and Li Lu, both of which are titans in the industry that I admire a lot. In Mohnish’s own words, I have been a shameless ‘cloner’ in making this investment. However, both Li Lu and Mohnish sold their entire stakes in Micron in H1’2023, worth hundreds of millions. Since I started by cloning them, this presents a direct call for action to follow their decisions. I tried to figure out why they sold, which I believe to be a combination of geopolitical risks (like how Buffett sold its TSMC shortly after it invested) but more importantly, they probably felt that one of the original theses crumbled. The thesis was that after years of ferocious survival-of-the-fittest competition, the industry was essentially left with 3-4 major players, which confer an inherent equilibrium and price rationality among the oligopolistic players. However, that thesis broke when Samsung announced in Dec 2022 that it planned to weather the 2023 recessionary period by expanding memory production capacity and slashing DRAM chip prices significantly, in a bid to preserve and increase its memory market share and in direct contrast to Micron or SK Hynix, who were slashing its capex program and laying off workers. To me, that irrational behaviour was the core reasons for Li Lu and Mohnish to sell their Micron. I went through all the facts and decided it was too premature to tell how the equilibrium will be broken and not strong enough a reason since 2 out of 3 players (a majority) were playing by the book. I decided to diverge from the legends and not ‘clone’ them anymore. On hindsight, this seems to be an good case study of independent thinking (obviously too early to say), but I was lucky that the tide turned so quickly owing to the surging AI chip demand, which at that time wasn’t entirely clear. Will this AI craze fizzle out and be a passing fad like many other previous trends, or will this be a true ‘revolution’ comparable to the PC, Internet, Mobile revolutions?

AK Medical (HK:1789) - AK Medical is one of the longest holding portfolio and it is regretful that I had to sell it (I have written about my thesis in previous post). I have followed the company since 2018 and watched the roller coaster price movements over the past 5 years. Essentially, most of my predictions about the outcome of the centralized procurement (Jicai; 集采) were largely spot-on, but what surprised me was that even though AK Medical emerged as a winner in this high-stake Jicai, the ‘benefit’ did not materialize. AK Medical had won the largest volume allocation from Jicai, but it won the bids with one of the lowest prices. This is in fact the whole premise of what the government wants to achieve - the higher the price cuts, the larger the volume (“量价挂钩”). It was touted as a way to force Company to keep improving its productivity and lower cost of production, to favour the leaders in the sector to consolidate further its market share, to squeeze out smaller players or prevent further unnecessary competitors from entering the market, and most importantly, for local leaders to replace MNCs (a.k.a. import susbtitutions or "国产替代”). However, the recent development obviously fell short of such expectations. The reality is more complicated. When the prices became too low after Jicai, although it is still at or above the ex-factory prices, there isn’t much juice left for the key stakeholders along the value chain - the distributors. The crux of the matter is that unlike drugs or other medical consumables/devices, orthopaedics are heavily dependent on these middle man service providers due to the number of variations and the complexity of the tools and instruments involved. That is why a player like Kangji Medical can choose whether they want to supply directly or still go through distributors after Jicai, whereas all orthopaedic companies have to still sell through distributors. They are the people who deals directly with the surgeons, nurses, hospital administrators, of which they have a huge influence on them. They are the customers that off-take AK Medical products and pay them. Hence, many of these distributors then resort to choosing and pushing those products that have won the bids at higher prices, to squeeze whatever margins that they can still get, or many of them gave up altogether (otherwise they will be doing the work without profits). There goes the most fatal collapse in the thesis, the lower the winning bids pricing are, it doesn’t automatically lead to higher market share, contrary to government’s intention and market’s belief. Once I realize this, however much I love the Company and the management team, I press the SELL button. This reminds me of Charlie Munger’s quote: “Show me the incentive, and I will show you the outcome”, an expensive reminder indeed.

The key follow-up question then is whether the other Medtech companies in the portfolio will be affected by this dynamics as well. This is something I am still monitoring closely and spend a lot of time thinking about.

Peijia Medical (HK:9996) - Peijia Medical had a rather unusual series of events lately. Its trading was suspended from 2 Apr 2024 to 17 Jun 2024, and the reason cited was because of a disagreement on accounting treatment of an investment product with the value of HKD 80mn (vs. prevailing market cap of c.HKD 2,000mn), leading to a delay in releasing the FY2023 audited reports and therefore in breach of a HKEX mandated rule. It came as a shock because only recently one of its fiercest competitor in TAVR, Venus Medtech, just got suspended due to a series of fraudulent acts by the CEO and founder Zi Zhenjun. Would this be some kind of a similar situation masked within a seemingly innocuous disagreement with accountants? As one of the initial thesis for choosing Peijia was the strength and integrity of the founder Dr. Zhang Yi, any form of trading suspension raises eyebrows and should get your antenna up, and it was all the more unbelievable that they let a rather insignificant amount of accounting disagreements to cause any reputational damage or uncertainty among investors. Nevertheless, after a couple of months of speculation, the Company released a public announcement that there is no need for any amendments or rectifying actions to the FY2023 accounts published previously. So far, all the subsequent communications and IR events didn’t show any form of foul play or lack of transparency. As expected, market didn’t react well to such kind of mysterious and unexpected events and the stock sold off forcefully thereafter, dropping from HKD 3.6 to HKD 2.2 shortly after trading resumed. The Company reacted by aggressively buying back shares the equivalent of 1.6% of total shares outstanding in a mere 4 trading days, apparently in a bold move to show the confidence of the management in the Company’s future prospects. In almost all circumstances when the stock is undervalued, anyone would cheer such a move, but except for one circumstance - the Company is short of cash. Similar to all other TAVR companies, Peijia is loss-making by subsidizing the doctors and ‘educating’ the market in its bid to grab market share and is operating at a negative GP margin for each valve that it sells. With assumptions on the run-rate cash burn rate, the cash on its balance sheet may only last them until end of 2025 or mid 2026 (i.e., they have to quickly achieve cashflow breakeven or else will go under). It doesn’t help that there is such deep pessimism surrounding the Chinese markets, earlier than expected onslaught of Jicai on TAVR and that in such environment those company that are loss-making or cash burning will get dumped by investors in a blink of an eye. Therefore, instead of helping to provide buoyancy to the share price, the share buyback was seen negatively by the market as a way to accelerate the emptying of its coffer. In any case, the Company stopped buying back shares after 4 days (whether it’s an reaction to the circumstances or due to HKEX blackout period, I am not sure). Having said that, I still believe in the Company’s strong product pipelines, management team’s execution competency, founders' integrity and alignment of interests and the inevitable shift to TAVR vs. open-heart surgery. I hope the management team can be more prudent in managing the cash to tide through this period. Two recent events provide some comfort: 1) Microport Cardioflow announced a drop of 65% - 72% in net loss, suggesting that Companies have become more rational and cutting back heavy R&D and selling expenses (though Peijia’s announcement didn’t mention about reduction in net loss); 2) Venus Medtech’s troubles continue to manifest itself with even more dire cash situation, leaving Peijia and Cardioflow more window to capture market share; 3) Peijia’s investment in a TAVR product indicated for both aortic stenosis and aortic regurgitation (Jenavalve) was acquired by Edwards Lifesciences for a high price, demonstrating the clinical potential of the product as its launched in China (rebranded as TaurusTrio) and the management team’s R&D acumen. I will continue to monitor Peijia’s development closely.

China Education Group (HK:839) - For the six months ending Feb 2024, CEG’s revenue grew 18%, while adjusted net profit per share grew 5% year-on-year. CEG continues to grow steadily in terms of revenue though margins have been impacted as the Company moves to hire more staff, renovate and install newer assets in preparation of the change to a ‘for-profit’ schools status. I expect school fees to continue increasing year on year, as they introduce various new degrees in line with the government’s push in certain industries. In addition, in a deflationary environment, I expect the staff remuneration expenses to increase less quickly. Going forward, I expect the margins to remain as the current level, while the tax expenses to increase once the colleges/universities got its ‘for-profit’ status. Nevertheless, at a current valuation of ~5x P/E and a dividend yield of 8-9% with a high level of certainty it will continue, I see this as more of a ‘fixed income’ high yield bond, with an optionality for an equity upside if regulatory uncertainty or macro sentiment improves. There are other more in-depth and nuanced discussions on the regulatory environment and whether the Chinese government can ever allow such a ‘high margin business’ to be ‘privately-owned’, but I shall save it for future posts.

Yihai International (HK:1579) - For the year ended 2023, Yihai’s revenue remained flat against last year but operating profit (excluding FX gains) increased by 9%. Yihai is one of the latest additions to my consumption stocks portfolio (along Jiumaojiu and Anta). In summary, Yihai is an associate company started by the Haidilao co-founders who saw an opportunity to supply its centrally produced soup base for 3rd party hotpot restaurants (in addition to its own fast growing Haidilao restaurants). The Company then ventured into other food processing segments - compound condiments (e.g., 酸菜鱼,麻辣小龙虾, etc.) and ready-to-eat food products (self-heating rice and mini-hotpots). Company has grown tremendously from 2013-2023 at a 10-year CAGR of 35% for revenue and 44% for operating profit, riding on both the growth of Haidilao restaurants as well as the growth in new segments. ROCE has been extremely high at 50-100% with cash reinvesting back to the business as they continue to expand capacity both in China and overseas. Share prices have whipsawed as it skyrocketed from HKD 3.2 from end 2016 to HKD 115 by end 2020 (>35x in 4 years!), but subsequently plummeted to HKD 11 by end 2023 (90% drop in 3 years!). If you look at the 7-year operating metrics of the business and the share price chart on a no-name basis, you would not believed in the slightest imagination that both charts belong to the same Company - again, Mr. Market never fails to baffle me. How did the same Company go from a euphoric 100x EV/EBIT to the current 6x EV/EBIT? There are a few reasons which I hold a contrarian view.

Recent stagnant growth due to multiple factors (Haidilao’s over-expansion during Covid and subsequent growth concerns, China’s ongoing consumption weakness, reversal of Covid-19 eat-at-home trends, deflationary pressures, etc.). My contrarian thinking to the current pessimism are that: 1) Haidilao will likely still be the leading hotpot chain in China in 5 years’ time; 2) Haidilao overseas will provide the next leg of growth for Yihai; 3) consumer spending in China will likely recover in the next 2-3 years; 4) Yihai will continue to innovate and launch new products (both B2B and B2C); 5) ready-to-eat products and condiments will continue to grow due to Gen-Z and millenial’s consumption trend. Despite the ongoing challenges faced by the Company, it still manages to maintain a flat operating profit of around RMB 1.2bn over the past 4 years. I believe all the pessimism has been more than priced in at a 10x trailing free cashflow, and I hope the management continues its share buyback program soon.

Trading with Haidilao is not arms length and profits are easily transferred between the associated companies. My view is that this should be expected as a natural extension of both companies being started from the same founding team. But more importantly, even in 2021 and 2022 where Yihai was accused of selling at low prices to help prop up Haidilao’s margins (at the expense of its own margin), there are still profits to be made. Ultimately, as long as they management team understands the line and continues to improve their independence, I believe net-net there are more benefits than costs from being associated with Haidilao (a huge anchor customer that is assured to be recurring will lead to factory production efficiency and better capacity planning, brand equity from Haidilao in selling its other food products, no or low receivable risks, etc.).

Pessimism on Chinese stock market - this is a broader question of whether China is still ‘investable’. Yihai, being a market darling previously, has experienced an even more severe pullback compared to other Chinese stocks (hopefully the reversal stands true when the sentiment ultimately changes). As in all prior market cycles, I still believe that the pendulum will swing back at some point, but as Howard Marks has expounded numerous times, it will be impossible to predict when that will happen.

Jiumaojiu (HK:9922) - Jiumaojiu is another consumer company that fits into my overall theme of domestic consumption with little regulatory risks as mentioned in my previous post. For the year ended 2023, Jiumaojiu grew sales by 49% to RMB 6.0bn, and store level operating profits grew 108% to RMB 1.1bn. 2023 saw an overall rebound in dining out as Covid restrictions were lifted in end 2022, leading to revenge spending surging across many consumer segments. While 2023 is a fantastic year, the focus should be on 2024 and beyond as the Company recently announced that Jiumaojiu’s PATMI H1’2024 declined sharply by 70%. Table turnover rates dropped across the brands and Song hotpot’s same store sales growth plunged by 37% year-on-year. This sharp deterioration in operating metrics have exceeded my expectations, and those of the other investors, which led to a decline in share prices in the past 6 months from HKD 5-6 to HKD 2.5. Consumer sentiments are weak in China, with many people cutting down on dining out, while F&B retail companies resort to a harsh discounts to lure companies, leading to margin erosion. Retail F&B has always been a fiercely competitive industry, and consumers always prefer the next upcoming brand or taste. However, one of my thesis for Jiumaojiu (I very much prefer Haidilao as a Company but the growth prospects are lower and I am already exposed to Haidilao’s economics via Yihai) is that the management team is innovative and constantly launching new brands/concepts to test the market, iterate and not afraid to close down if things didn’t pan out as they expect. They are a clear leader in 酸菜鱼, and I believe they will find the next leg of growth in other brands, as well as finding success in overseas market. Meanwhile, we will have to be patient to see when consumer spending will normalize in China, but with a net cash balance of RMB 1.8bn as of Dec 2023, and Company buying back shares and paying dividends, the risk of losing money in 5 years time is low (in my opinion).

Thank you for your attention. Lastly, I will end this post with the following quote:

The number one idea is to view a stock as a part ownership in a business and judge the staying quality of the business in terms of its competitive advantage. Look for value as the discounted free cash flow against the amount you are paying for. You have to understand the odds and have the discipline to bet only when the odds are in your favour. We just keep our heads down and manage the headwinds and tailwinds as best as we can, and take the result after a period of years.