Q3 2023 Results and Thoughts

Dear Investors,

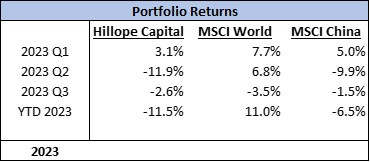

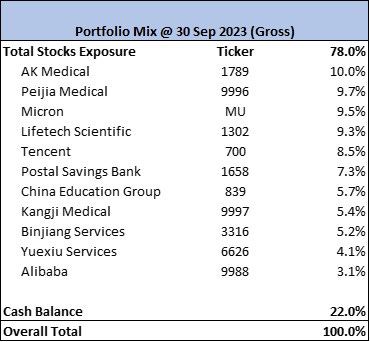

Below is the return summary for Q3 2023, as well as the breakdown of top holdings:

Key Portfolio Updates

During the quarter, I have completely sold my holding in 3SBio and continue to add to my position in Binjing Services.

On the Art of Selling

Among my portfolio companies, I would consider 3SBio to be a growth value stock - an oxymoron that I define as a company possessing a rare combination of high growth (>15% earnings CAGR for >10 years) and low valuation (<10x P/E). As Mr. Market remains sane most of the time, such a ‘gem’ in the stock market is indeed rare. Experience teaches us that if something is too good to be true, it usually is. I was very skeptical at first and more so because the company is in the pharma industry which I have to admit is definitely outside my circle of competence (and it still is today and likely be so for the rest of my life).

I am sure many investors have looked at companies before where the P/E (or any valuation metrics for that matter) optically looks enticingly low, but it later turns out that the Company is on the cusp of either an earnings cliff as the industry dynamics turn sour or a sudden loss of a large customer, or in some cases a huge one-off expenses due to a ligitation or patent infringement, etc. There are many reasons why the mass intellect prices a stock cheaply, and that’s why the intrinsic value of a business is all about how much cash can be extracted out for the remaining life of the business. In other words, stock price is about prospects, not what has transpired before. And off I went digging into the business, industry and prospects.

However, after much research, I was convinced that 3SBio has been unfairly discounted and the prospects look decent, even taking into some conservative assumptions about its pipeline drugs and reimbursement scenarios. Furthermore, as the Company derives most of its sales from just 2-3 drugs, and has found another leg of growth in consumer products (hair loss and acne treatment), I was getting more comfortable with the Company. Hence, I bought the shares and held it for more than 3 years (first bought since May 2020). To give you a sense of how absurd it is, the Company’s sales have grown 10x from 2012 to 2022 (compounded at 26%) and operating profits have compounded at an staggering rate of 31% for 10 years; all the while maintaining GP margins at close to 85% while operating margins at 27-30%, but yet it was trading at around 8-9x P/E!

The question you may ask is then - why do I sell it now? And the TLDR answer is the age old value investing tenet: Invest only in a business you understand.

I do not understand the capital allocation of the management team - Company generates a lot of cash but doesn’t buyback shares aggressively, dividend them out or make M&As. I was patient at first but after 3 years of tracking it (and a couple of scratch-my-head type of capital market transactions), I start to wonder if the founder has any clue about capital allocation, or even bother about shareholders interests or both.

Lesson learnt: follow the Company as though you invested the stock 3 years ago at that prevailing price. This helps to eliminate some psychological biases. Read all the reports, transcripts, interviews, forums, glassdoor, etc. and assess the capital allocation skills and integrity of the management. Compare words to actions. If the share prices have been falling for 3 years since the ‘hypothetical’ entry price (usually the case for value investors), it is a good way to really test the contrarian convictions. On the other hand, if the prices have been rising, it is also a good way to see if the margin of safety is still good at the elevated price. In any case, try to feel the emotions as though you bought the stocks 3 years ago.

I do not understand how poor their R&D progress is. Because of my lack of knowledge in pharma industry (again, outside my CoC), I didn’t realize that the progress of their pipeline drugs are really slow, having assume that drug R&D always take time. Although I have discounted most of their R&D pipelines, they would still look cheap given the existing drugs are gushing out cash for the foreseeable future and the consumer unit is growing well. However, for pharma companies, I have learnt that the prospects and R&D pipeline are where the market gives them value.

Lesson learnt: Always, always read the competitors to get a sense of the relative performance and whether the Company has true competitive advantage. If I had just look at BeiGene or Innovent or Jiangsu Hengrui, the difference in R&D spend or pipeline progress will be obvious.

I do not understand why Hillhouse bought into 3SBio a sizable stake and then sold within 1.5 years. They were known to be heavily invested in pharma and has a strong healthcare team. Though I usually don’t read too much into what other funds are doing, this does seem to suggest a potential red flag?

With any buy or sell decisions, the key question I always ask myself is, with the information on hand, will I buy the stock if I have the extra cash in my portfolio, weighing against all the other potential stocks I can buy. If the answer is no, then I will sell it if I am holding the stock. This definitely doesn’t pass the test, and hence I sell it, and made a 15-20% overall profit off the stock.

Selling in a profitable situation is not too difficult, since the saying goes ‘You never go broke on taking a profit’. However, after reading and studying so many great value investors, it does seem to suggest that the biggest mistakes these investors have made in their career are those of omission rather than commission, i.e. selling winners too early. That’s the reason why I always err on the cautious side whenever I am selling. However, in this case if you have determined that the reason for selling is not that the price has reached above its intrinsic value, but is because the company is outside of my CoC in the first place, then it wouldn’t matter. Those profits, if it ever materialize in the future, are not made for you anyway.

On the other hand, if in this case the situation is the reverse, e.g., the stock is down 25-30% and I have come to the same conclusion, would I have been able to fight the psychological bias and keep the rational decision of selling at a loss? This hypothetical situation shall be a question for the future, and a true test of whether I can stay rational in my investment decisions.

That’s all for this quarter. Thank you once again for reading.