Renrui HR / 人瑞人才 (HK: 6919)

Leading Flexible Staffing Provider in China

I started Hillope Capital as a vehicle to compound my wealth and learn as an investor. My investment philosophy is documented here. When I research and evaluate a company, my thought process is guided by the following four questions:

Do I understand the business well?

Is the company likely to enjoy sustainably higher earnings in five to ten years’ time?

Do the founders or management team display a long-term oriented mindset, sense of integrity and good capital allocation skills?

Is the price attractive relative to the intrinsic value?

In this post I will document the thought processes behind my decision to buy Renrui HR (HK: 6919), which I initiated the purchase from Dec’20 to Jan’21 at around HKD 26.

Business Introduction: Founded in 2010, Renrui is a leading HR solutions provider in China focusing on providing flexible staffing solutions to many large corporates and fast-growing unicorns. From 2016 to 2020, Renrui has grown at a staggering 66% CAGR, reaching RMB 2.8bn sales in 2020, driven from rising demands from its fast-growing customer base and its ability to leverage technology to deliver better value to customers.

Summary of my investment thesis (TLDR version):

A leading player in a large, fast growing but underpenetrated market – 3-pronged growth engine driven by i) overall economic and employment growth in China, ii) increased penetration rate of flexible staffing and HR outsourcing, and iii) rising market share amidst industry consolidation

Carved a strong niche in the fast-growing unicorn startups sector, with attractive optionality in other related HR or BPO services

Focused on providing value to customers through its technological platforms and ecosystem, creating a network effect connecting employees and employers

Low margin is deceptive; Strong return on invested capital

Led by a visionary ex-Huawei HR veteran and core co-founding team from ChinaHR.com, management has so far proved to be strong, hungry, honest and incentive-aligned.

Aligned with government’s policy directions and generally supportive regulatory environment

My estimate of intrinsic value yields around HKD 50-70 per share

Key Potential risks and concerns:

With AI and machine learning progressing leaps and bounds, there is a risk that increasing automation of mundane or manual jobs will drive away the need for those jobs (data verification, customer service, call centres, etc.) that rely on flexible staffing

Customer concentration – largest customer Bytedance consistently contributes >30-35% of sales

Large scale VC capital market crash with many startup customers laying off workers and changing attitude towards rapid hiring and expansion

Company experienced the Mobike debacle but impact was minimal

Reputational risks from mistreating its contract staff, or understating costs (social insurance)

Lack of evidence for strong M&A execution capability

Ability to attract right talent and maintain strong corporate culture as the company grows

1. Leading player in a large, fast growing but underpenetrated market

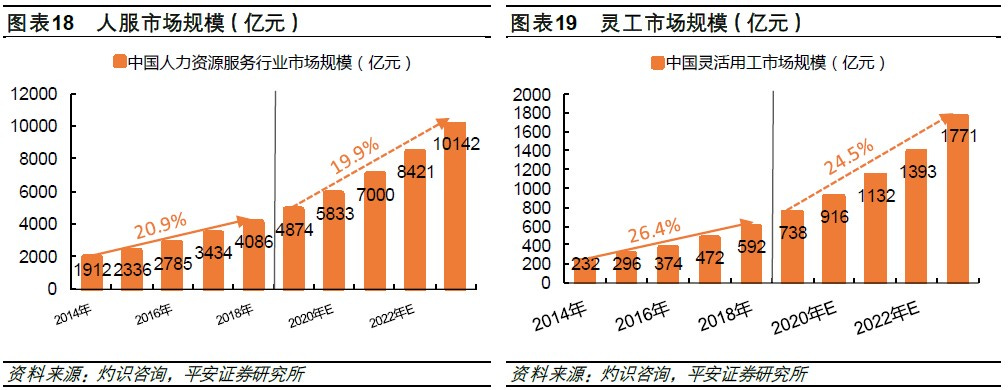

According to CIC Report in the Prospectus, overall HR outsourcing services market has been growing historically at ~20% p.a. from 2014 to 2018 and reached c.RMB 200bn in 2019. This trend is expected to continue going forward, with the flexible staffing sub-segment leading the growth at ~25% p.a.

With little understanding of the HR sector, I was initially surprised by such a fast industry growth rate. I now believe there are two key factors that explains the growth rate and why I think this rate can be sustained.

A key macro theme over the past decades in China has been the underlying structural shift in China’s economy from agriculture and manufacturing driven to one that is services and consumption driven. If we look at the data from OECD and World Bank, services-producing industries account for an overwhelming share (>80%) of the total employment added.

Under the backdrop of this structural shift is the second largest economy in the world growing at a fast pace for a very long time. Such vibrancy in economic growth, coupled with continued urbanization, means large number of companies and jobs are being created in those sectors that demand the kind of talents and skills that require HR services and outsourcing.

Think tech companies like Alibaba, Bytedance, Meituan, or retail companies like Miniso, Haidilao, etc. and their supporting industries like logistics, customer support, call centres, data verification, etc.

The ratio of flexible staff to all employees in China is <1%, compared to developed countries at mid to high single digits. As China continues to move away from manufacturing-oriented economy to more service and consumption-driven economy, the penetration rate is expected to continue rising to the level similar to the more developed economies.

Renrui’s current market share in flexible staffing is c.2-3% in terms of number of staff and c.3-4% in revenue, and is the top player, with a close competitor Manpower Group China (HKSE:2180) slightly behind. Industry is highly fragmented in China with the top 5 players only accounting for <10% in terms of sales revenue. In contrast, top 5 players in developed countries with longer history and more mature staffing and HRO services usually command 20% or more market share. This bodes well for the ‘big gets bigger’ story for Renrui.

2. Carved a strong niche among the fast-growing unicorns, with upside optionality

Renrui first started out as a training school in collaboration with colleges to train prospective job seekers in customer service skills and then offered them jobs in Amazon. As Amazon expands in China, its demand for customer service roles exploded and Renrui landed its first large recruitment process outsourcing (RPO) contract with Amazon. With a global player such as Amazon providing a strong credential and seeing the opportunity in the fast-growing startup scene, Renrui has managed to speed up its growth and widen its customer base, mainly focusing in customer service.

The next breakthrough happened in 2016 when Renrui worked with Bytedance to help them with flexible staffing solutions on information verification roles due to their large volume of UGC. This quickly grew exponentially given Bytedance’s mind-boggling growth in recent years, and Bytedance is now the largest customer with almost 40% sales in FY2020.

Such a growth story reminds me of a core concept I recalled in the book “The Innovator’s Dilemma” by Clayton Christensen. The author describes how disruptive innovations often first take root in some niche areas of a market where the margins may be too low, returns not as attractive or inconsequential to the large incumbent players. This then allows a new player to come in and experiment with new ways of doing things, gradually innovating and improving on its products or services which eventually redefines the industry or grab the market share from the incumbents. In a similar fashion, among other HR services market, Renrui chose to first enter the low margin business of flexible staffing in the low-value staffing roles (customer service and information verification) but managed to build its reputation, established the platform and systems for growth and now become the leader within the fast growing flexible staffing sector. In the FY2020 reports and result briefing, management made it clear that the company will next focus its resources on growing both the BPO business and the IT Outsourcing business, which have higher margin and more sticky.

I believe with the core operations growing and a strong niche footing, Renrui has many options to grow. Just like how Amazon started out with selling books online (a niche vertical) and then selling everything under the sun, Renrui can gradually penetrate and compete in other industries (from ‘new economy’ to retail or finance sectors), or move towards higher margin placements (Company’s recent strategy towards IT Outsourcing or placement of engineers), or follow clients such as Bytedance in their overseas expansion (which they have started to do), or totally new HR service offerings (HR software, compensation & benefits, HR consulting and training, etc.). Management has also indicated their intention to acquire companies who can provide more tech-enabled capabilities which can help them source for more candidates, provide AI functions or improve existing operations. It will be interesting to see their first M&A announcement, which can provide a good flavour of how management allocates capital and thinks about future growth strategy.

I do acknowledge that I maybe a victim of representative heuristic bias here, and that the above association or extrapolation may only be my own hypotheses. I try to remind myself not to place too much weight into the positive association or be carried away by my own connections between the dots, I hope the damage from falling into such a bias will be minimized. I always try to focus on management’s ‘actions’ taken and I do hope that time will prove me right.

Side Note: More on ‘Information Verification’ jobs

Information verification, or what the West calls content moderation or human moderation, is a totally new type of role being created due to the internet economy and social media platforms. Basically, the job of a content moderator is to ensure that user generated content (UGC) being uploaded to a platform abides by the rules and regulations of the country. Typically, it means go through a vast amount of pictures or videos to ensure there is no violence or abusive content, pornography, cyberbully, and in China, political sensitive topics.

These roles have come into the spotlight recently due to various reports in the US of content moderators working for Facebook or Youtube developing depression and post-traumatic stress disorder symptoms due to their constant exposure to explicit, sadistic or violent content.

It is fascinating that despite all the money being poured into researching AI and facial recognition by the leading startups and internet giants, machines are still pretty poor at content moderation, often being over-zealous in its algorithms which leads to incorrect takedowns. Youtube has notoriously said it will bring back more human moderators in Sep 2020 after less than a year that they said will rely more on AI and machine learning to filter out content. This admission of failure by a leading internet giant looks like a huge slap in the face of the seemingly all-encompassing AI technology. I believe that it will really take time for AI technology to improve to a level where it can replace human totally. Meanwhile, machines and humans will have to work together to filter out the growing UGC content.

3. Focused on creating value to customers

In general, for any stock I research about, I always try to understand what exactly is the value that the company is providing to its customers and society in general. I always try to look out for companies or founders who are fanatical about creating value to its customers. In Renrui’s case, I believe the key value proposition lies in its ability to efficiently recruit, deploy and retain employees for its customers as the business needs of its customers grow or change. In today’s fast-pace and dynamic environment, companies face tremendous HR challenges as they grow organically, face greater regulatory oversight or shift strategic directions. Outsourcing part of the HR functions allows them to stay lean and agile, keep overall costs down, drive higher efficiency, transfer contractual risks and keep up with growth.

One of the key insights I derive from studying the company is that, on a macro-economic level, the core value proposition of a business model such as flexible staffing or RPO is to transfer repetitive but important HR tasks from a non-specialist entity (most companies do not see HR as a core activity) to a specialist entity whose bread and butter is HR. Economies of scale dictates that a specialized entity should always be more efficient in delivering the output. Like many other established corporate outsourcing industries (IT, payroll, accounting, marketing, etc.), the mental model I have for Renrui is one where it becomes the permanent extension arm of many corporates’ in-house HR department, aggregating and matching the supply and demand of various companies/employees.

Renrui has over the years leveraged on technology and built a series of proprietary software systems and platforms to have a fully integrated HR ecosystem, comprising of the following:

Xiang Recruitment App (香聘) – O2O app portal for job seekers to search for openings, schedule interviews and for employers to post job listings, which acts to increase talent pool.

Rui Recruitment System (瑞聘) – internal portal for Renrui’s employees to manage the entire recruitment process of each project and has built-in analytical tools and algorithms to tag individuals’ CVs and job preferences, and conduct smart matching in real-time.

Rui Cloud Management System (瑞云管理) – a core web-based SaaS portal accessible by clients, Renrui’s employees and contract staff (via Rui Home Platform) to conduct all administrative tasks (e.g., leave application, overtime records, attendance checking, checking salary payments, etc.). As a value-add to clients, Renrui offers module customisations and allows docking of the portal to link the system to clients’ existing HR data to increase efficiency.

Rui Home Platform (瑞家园) – one-stop interface built on WeChat Public Account for all contract employees of Renrui to perform admin functions (e.g., leave application, key personal data), network with other employees (via chat groups and internal short-video platform Xiami Video), and offer referrals to get rewarded.

Integrated Contract Management System – underlying central database and backbone that standardize all contracts and data warehousing to enable the above applications

I believe the self-developed systems and platforms provide a certain level of “moat” in that Renrui is able to deliver its services (recruitment, onboarding, retention, etc.) faster or better than its competitors, and Renrui’s technology development centres around maximizing efficiency which is more practical. This reflects in the lower attrition rate (from 2016-6M19, an average ~10% of flexible staffing employees departed or were terminated before the end of their contract term vs. industry average of 15-20%) and client renewal rate of 100% for those clients with revenue of >$1m.

Side thoughts on Xiang Recruitment: On Xiang Recruitment app, I looked through the Zhihu comments and generally feedback is negative on the app and the company (with most comments along the line of not being transparent that they will be signing contract with Renrui rather than Bytedance, and interview process not being run properly, etc.). On one hand comments like this on forums/Zhihu are always selective biased, but it still provides some context into whether various stakeholders are being well served by Renrui. It would be much helpful to hear comments by customer’s HR personnel but I wasn’t able to find them.

On the statistics of the app, according to Qimai (七麦), Xiang Recruitment also ranks poorly as compared to other aggregator platforms such as Zhaopin or 51jobs, with monthly downloads and active users being small and growth slow. However, this doesn’t concern me as much because i) they are not directly competing against these other online job portals; ii) they didn’t spend the kind of marketing and lead generation expenses; iii) they are targeting a subset and rather niche segment for lower-skilled workers

4. Low margin is deceptive; Strong return on invested capital

Renrui’s GP margins are low at ~10-11% and operating profit margins at ~5-6%, which is lower than other competitors due to their higher mix of flexible staffing in lower-skilled workers. However, their flexible staffing margins is equal to, if not slightly higher, than industry average. Most people may have likely dismissed such a business arguing that a low GP margin business naturally means that the competition is fierce, switching costs are low and bargaining power is limited. This kind of System 1 thinking and jumping to conclusion can be costly (just ask those early investors who miss out on Costco).

My analysis suggests a rather different picture. Renrui’s flexible staffing business model operates in such a way that the Company only executes and mobilizes resources to hire staffs after a customer confirms the staffing requirements, pricing and contract terms. In the language of a manufacturing company, it is often called “make-to-order”, which means the company doesn’t need to stock up inventory to fulfil its customer orders, and only starts production after they receive purchase orders from their customers. Companies blessed with such a wonderful business dynamic are rare in the manufacturing world (usually reserved for big ticket items or ultra-luxury products – Boeing jets or Birkin bags?). Such a business usually means cashflows are good with low working capital requirements, which indeed is the case for Renrui.

There is a risk of clients terminating their entire contracts mid-way, which releases a large number of staff but historically the number has been kept at ~1% termination rate. In such scenarios, the client will have to provide prior written notice (which gives time for Renrui to plan its labour pool deployment), and pay them a liquidated damage and as well as compensate for losses. The other risk lies in the client terminating the contract staff due to performance issues (historically between 1-2% of all flexible staff are being terminated due to performance reasons). The bigger issue, which Renrui is well-aware, is the turnover rate of contract staff as Renrui typically offers free replacement services. This is a key operating metric that the management team monitors and has been trending downwards. In any case, Renrui retains the discretion to terminate its employment contract with the staff in accordance with the local employment laws and regulations.

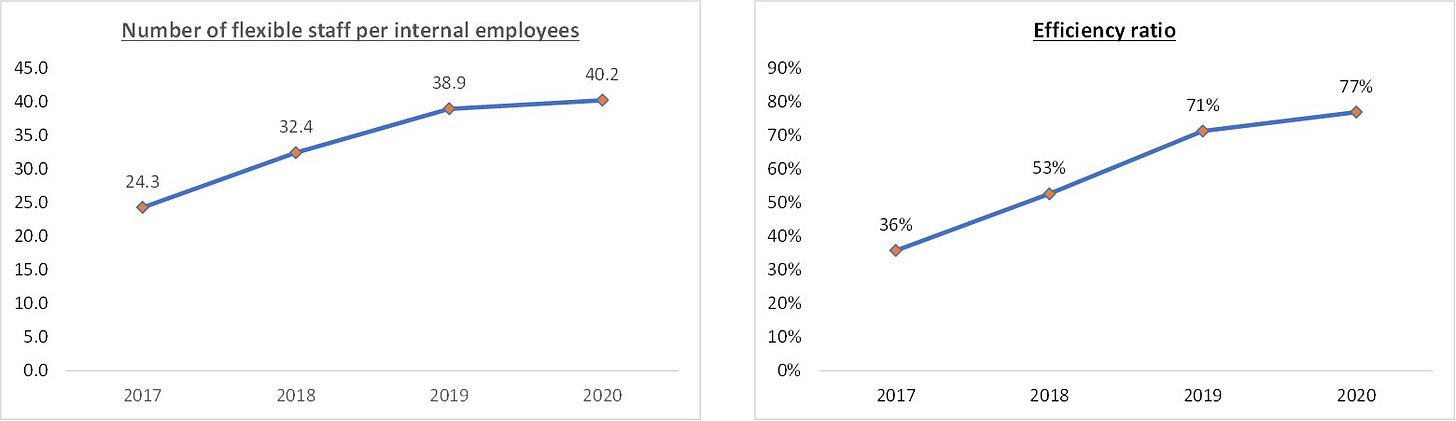

In summary, Renrui’s flexible staffing model has a clear mark-up of 12.5% service fees on the total staff labour costs, with very minimal idle staff lying around under the payroll of Renrui. As Renrui gets bigger with numerous clients in various industries, geographies and seasonality, it should get easier for Renrui to manage its labour pool for redeployment. This then essentially boils down to one key performance metric – number of deployed flexible staff. In praise of management’s transparency, the company discloses this number every single month since Sep’20 and the rebound in numbers since Covid has been spectacular (>40% yoy growth every month since Nov’20).

It is no surprise that the ROIC is exceptionally high for such a business at ~100-110% for 2019 and 2020. In fact, this business requires little capital to generate returns, and the question is whether the company can continue to find new customers and grow with its existing customers, which I believe the industry tailwinds and consolidation as mentioned above bode well for Renrui.

I would be careful to draw parallels between Costco and Renrui, but I do believe that they share some similarities in that both have loyal or sticky customers (though Costco is much stronger with memberships), both have low margins (fixed mark-ups) but can grow like a clockwork through constantly delivering value to customers, large addressable market, and opportunity to improve margins through sales intensity (in Costco’s case it is sales per sqft whereas for Renrui it is number of flexible staffs per each internal employee). If we look at the efficiency ratio (defined as EBITDA divided by GP), you can clearly see the benefits from economies of scale.

I believe a really exciting aspect of Renrui is that in addition being able to continue growing its core RPO business for ‘new economy’ clients in the info verification and customer service sectors, as Renrui continues to explore other optionality, its margins will inevitably go up. Hence, I do see a double impact on future profits from both revenue growth and margin improvements.

5. Strong, Driven, Honest and Incentive-aligned Owner-Operator

Renrui first came into my radar from my general reading. I remembered being first intrigued by its superb growth and falling share price, but what really captivated me and made me delve deeper into the company was when I read about the company’s founder. I always love to read about the life experiences, career choices or past interviews of company founders. Short of being able to meet with them directly, I believe these anecdotal information does give a view of the competence and personality of the founder.

Renrui was founded in 2010 by Zhang Jianguo (张建国, or ZJG), who has >20 years of HR experiences and is one of the early pioneers in the internet HR industry in China. Among the numerous successful founders that China has bred over the years, ZJG’s experiences and credentials still stand out.

In 1990, like many young Chinese during that era who dreamt of striking it big post China’s economy opening up, ZJG left his comfortable job as a university teacher in Lanzhou and ventured to Shenzhen to find a job. He landed in a 3-year-old company called Huawei as the 25th employee (Huawei now has ~200,000 employees!). In his 10 years working in Huawei, he was put in various roles from Sales, Product Development but eventually settled on HR, and was instrumental in his contribution to the management philosophy of Huawei (“华为基本法”).

Like many other great companies, Huawei’s unique culture and HR strategy undoubtedly contributed to its success. Many of its ex-employees also went on to start their own business and became very successful. In ZJG’s own words, by participating in such a tremendous growth story of Huawei from 25 employee when he joined to 20,000 employees when he left, he has encountered and helped solve practically all management and HR problems one can imagine in a fast-growing organisation. I believed his formative years in Huawei has helped shaped him into a great leader and manager.

After Huawei, ZJG started to find his next challenge and went on to work in a few HR consulting firms as the General Manager, advising many corporates, large and small, in China. Around 2004, Cathy Xu (徐新), the investor of ChinaHR.com and later became one of the most successful VC investors in China, headhunted and persuaded ZJG to take on the CEO role of ChinaHR.com. ChinaHR.com, though was the first internet job search portal in China, was experiencing slowing growth and facing tremendous competition from Zhaopin and 51jobs. ZJG accepted the challenge. From 2004 to 2009, ZJG managed to turn around ChinaHR.com and grew both sales and profits, which eventually led to the full acquisition by Monster.com. This experience exposed him to the fast-pace internet-based HR economy and its competitiveness, while also learning from the best-in-class from a global powerhouse (Monster.com invested 40% in ChinaHR.com in 2005 before acquiring 100% in 2008).

Another key anecdotal evidence of ZJG being a great visionary leader is that two of his ex-colleagues in ChinaHR.com, Zhang Feng and Zhang Jianmei, are willing to quit their jobs to join him as co-founders of Renrui. Zhang Feng is now the COO of Renrui while Zhang Jianmei is the Sales VP. Both of them worked very closely with ZJG back in ChinaHR.com. According to the prospectus, ZJG gave each of the two co-founders 58 million shares, roughly ~4% stake.

ZJG is also well-regarded in the HR industry in China, seen as an industry veteran particularly in the new model of flexible staffing, and has published a couple of books on HR strategy and management (经营者思维—赢在战略人力资源管理) and Flexible Staffing (灵活用工——人才从为我所有到为我所用).

Though it still remains to be seen as company was only listed in Dec 2019 with limited track record, so far ZJG has came across as a visionary leader, curious and driven, embodies the highly successful Huawei culture, proven turnaround as a CEO, and has a close-knitted and strong founding team. All of these gave me comfort that Renrui has a strong management team and company culture.

6. Regulatory support and policy alignment

From my understanding of the Chinese government’s political culture, ensuring good employment growth and supporting job creation rank high on the political agenda and are key considerations in policy-making. As such, in recent years we have seen the government announcing new employment policies and regulations that support flexible staffing sector, particularly in response to keeping up demands of new economy sectors. There are numerous government releases or speeches touting the need to support the industry1. For example, in July 2020, Premier Li Keqiang said the following:

“要取消对灵活就业的不合理限制,引导劳动者合理有序经营。”

“过去很多人一讲就业就是‘固定工’,现在要转变这种观念”

One of the major risks when investing in China are regulatory risks, which can often be unpredictable (think Ant Financials or Alibaba recently). Although I am not an expert in employment law in China nor have I spoken to any experts on this topic, I believe this sector’s risk exposure should be low.

http://www.gov.cn/xinwen/2020-08/14/content_5534528.htm