New Journey in 2023 - Hillope Capital Letters

A formal investor letter to track my performance and share my thoughts

Dear Investors,

As we bid farewell to a tumultous and dramatic 2022 and welcome a brand new year, I have decided to start in the new year with a more formal semi-annual investor letter. This letter will be sent to all my investors (mostly my own wealth and my friends and families’ money) and be made open to all substack readers of Hillope Capital. There are a few reasons I am pursuing this.

Mohnish Pabrai has advised that the best way for any aspiring investor to start managing a fund like his Pabrai Funds is to first start investing with his own real money (regardless of the amount), practice the art of investing and formulate your own investing framework, learn and read ferociously about all companies to define your own circle of competence, then move on to managing your friends and families’ money. Then if the investor is any good at all, it won’t be long before the results speak for itself (at least a 3 to 5 year period and the timing of market cycle matters) and people will start noticing your track record as an investor and fund manager. This investor letter is my attempt to do exactly this - operate as though I am already a fund manager (short of regulatory compliance, audit and fund admin), document my portfolio holdings, investment buys and sells, and overall performance on a semi-annual basis (at the same time keep reminding myself that short term stock price gyrations shouldn’t matter), as well as a way to force myself to pen down my readings and thoughts on a regular basis.

The last point is particularly worth highlighting. While human brains are wired to remember the bad more than the good (loss aversion), we are also notoriously good at somehow forgetting the painful experiences and repeating the same old mistakes. As such, it is important to have a post mortem and a written record to thoroughly understand the investment mistakes made and make sure it sticks well in our memory. So far in the past 3 years of investing, I have made a few mistakes which have caused me a fair bit of pain and some fortune. I shall write more about my investment mistakes in future posts. In addition, what is more important for me to write this investor letter is to document down the investment thesis and thinking behind each company in my portfolio. This helps to keep track of the companies business performance and be less affected by the noise surrounding the macro environment or short term share price movements.

Reflections and Recap on 2022

Over the past few years, it is amazing to see how the Covid-19 pandemic has changed human behaviours on a global scale. From the initial stages of fear of the Covid-19 virus, avoiding crowded places, excessively hand-washing, routinely wearing masks and having virtual conferences online, many people have now reverted back to the old days of modus operanti for those countries that have opened up. If we read the headlines for most of 2020 and 2021, it is easy to conclude that ‘Covid-19 will upend many industries in the foreseeable future’, or ‘Covid-19 will change human behaviour forever’, etc. Although for now we still can’t say we are 100% back to pre-Covid days, but if we fast forward another 3 years to end of 2025, barring any new potent variants, I am pretty confident that as a general population most of our economic and social activities will be back to where we come from, i.e. before Covid-19 wrecks havoc in Jan 2020. Covid-19 will change all history textbooks, but it won’t change our fundamental human behaviours and our deep-seated need for social interactions.

Although this substack blog has been mostly quiet in 2022, I have been very active in terms of reading and thinking about my own portfolios, as well as researching about more companies across a broad spectrum of industries (hopefully I got time to write more about them in 2023). Over the past 3 years since I started to invest using the current value investing philosophy, there are a few major errors of judgment and lessons learnt. They came from the following companies: Perfect Medical (HK: 1830), Renrui Human Resources (HK: 6919), Graftech International (NYSE: EAF), Genetron Holdings (NASDAQ: GTH). I hope to share more about them in future investor letters.

Portfolio Holdings and Return Performance

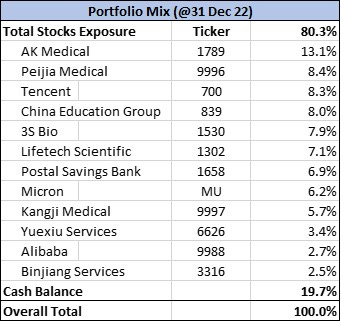

Going forward, I will show my portfolio holdings and overall portfolio returns as at 30 Jun and 31 Dec of each year starting from 2023 onwards (do expect a 30 to 60 days delay in publishing the letter). To reiterate here again, my goal as an investor is to compound wealth at a 5% point higher than the benchmark index on an annualized basis over a holding period of at least 5 years. The two benchmark indexes I have chosen are MSCI World Index (USD) and MSCI China All Shares Index (USD). I seek to disclose all my holdings, buys and sells such that at any point in the future, anyone can easily audit my returns. My portfolio as at 31 December 2022 contains 12 companies, with maximum exposure of 13% per stock, and a cash holding of 20%.

Is China Still ‘Investable’?

Over the past 3 years, China has experienced so much change from both external macro events as well as domestic issues. Regulatory crackdown and scrutiny on various industries (K-12 education and after school tutoring, tech industry and platform companies, volume-based procurement in healthcare industry), prolonged debilitating Covid-19 measures, escalating US-China trade war, global supply chain disruptions, domestic political uncertainties, etc., have all pushed the narrative from both Wallstreet and Mainstreet to deem China as “uninvestable”. Readers of my blog or people who know me personally will know that I am generally bullish on the future trajectory of the overall Chinese economy (and by extension Chinese companies). That’s why I have devoted most of my time and attention so far to studying Chinese public companies.

If you asked me this headline question of whether China is investable in late October 2022 (right after the 20th China Congress), I would have wavered in my conviction and gave an uncertain answer of ‘maybe’, which is a stark change in my stance. This is because the events that have transpired leading up to that Congress, and the decisions that the Chinese government has chosen have all pointed to the inconceivable scenario that socialist idealogies and political power centered on one man trumps all other considerations. I was questioning myself whether there is still room for value investing in China, and that perhaps I am biased to keep believing something that I hold dearly when the facts have changed (indeed, a precedent-breaking 3rd term is a historic change in the course of modern China’s political history). It is little wonder that some eminent investors have avoided totally all Chinese stocks, citing political risks as too high and too unpredictable.

As soon as the dust has settled on the 20th Congress meeting, China has embarked on a drastic change in both regulatory tones and actions across many fronts - stabilising the economy being viewed as the top priority in 2023, acknowledging the importance of property sector, shifts in the ‘wolf warrior’ foreign policy and most notably opening up the country after 3 years of harsh Covid-19 policies. It is as though everybody, including the China experts both East and West, have all misread the signals coming out from the meeting. Did the top echelons of power in China really changed their minds in such a short time after the meeting? I highly doubt so. Nevertheless, political unpredictability is not a good environment for companies and economy to thrive. To my relief, the worst case scenario hasn’t transpired yet and there are numerous encouraging signs so far that ‘this too shall pass’ in China’s inevitable rise as a balancing superpower to the U.S. and her democratic system of governance. However, given the unpredictability and opaqueness of the inner workings of the CCP, I think it is still too premature to have a definitive answer to the above question. The key period to watch will be the next four to six months of 2023 and the actions taken by the government. The government needs to act decisively to shore up investor confidence, and not rhetorical pledges by some high-ranking officials. Actions speak louder than words, and so far the Covid-19 turnaround has proven their resolve. The speed at which the Covid virus has spread in China is astounding, which means they will emerge faster than what we expect (with the sad but inevitable deaths associated with all previous Covid waves around the world). With the Covid overhang hopefully subsided in the next 2 to 3 months, China’s consumption and economic activity should rebound strongly.

On Medical Device Industry in China

Medical device companies currently constitute one-third of my overall portfolio. This seemingly concentrated bet on a single industry is worth spending some time to lay out my thoughts. Though the companies themselves are in different sub-sectors of the medical device industry, they will all be subjected to the same macro-economic trends and regulatory forces. Amidst the recent regulatory headwinds impacting this industry, mostly from volume based procurement (VBP), I have spent much time reading and thinking about the potential risks on the companies in my portfolio.

Update on Joint Replacement VBP and AK Medical

Readers of my previous AK Medical write-up (link here) will understand the basics of VBP and my predictions about the probability of AK Medical winning the VBP tender and the magnitude of price cuts, and their corresponding impact on the sales and margin %. Now that the results of the joint replacement VBP was announced in Sep 2021, it is comforting to know that my prediction of the most likely scenario has indeed come true. This nationwide tender has a total volume of 540k units across all hip and knee products (total value of RMB 20bn), of which AK Medical’s expected procurement volume share is the highest among all brands at 14%. AK Medical won all tenders with a relatively acceptable price bids. Market participants were relieved and share prices of most orthopaedic companies rose sharply in reaction to the clear softening of this tender round, both in terms of lower price cuts and better policy guidelines (as compared to the coronary stent VBP). The key policy highlights are:

Separated all companies into Group A and Group B to differentiate the major players who can supply to all provinces, and allow direct competition between local brands and foreign brands in Group A. This further reflects the “国产替代” trend while ensuring a fair game for everyone.

Overall average price cut of 82% as compared to the >93% in the previous coronary stent, with hip product prices being cut from RMB 35k to RMB 7k and knee product prices cut from RMB 32k to RMB 5k. A 82% price cut for such a huge nationwide volume is indeed reasonable. Though it is only a 10 ppt difference between a 80% price cut vs. a 90% price cut, it can have a world of difference in terms of the GP margin impact. As shown in the table below, a 10% price cut can reduce GP margin by 30% (of course with some simplifying assumptions but the concept remains valid).

A tender win rate of 92% (i.e. 44 out of 48 companies won the tenders). Such a high win rate ensures that companies won’t be forced into a “win or go bust” situation and bid for ‘crazy low’ prices.

New regulatory rule to include a separate fee for “伴随服务”. This clearly shows the principle of “一品一策” and that the authorities listen to the industry voices, acknowledge and understand the nuances of each industry and doesn’t apply a one-size-fits-all solution.

While the outcome of the VBP has been decided, the impact on the company’s financials are yet to be seen. I am confident that my predictions for the sales and margin impact will hold, though in the initial 1-2 years of implementation we may see some slight margin compression as AK Medical adjusts its operating and sales model. FY2022 will be the first year of implementation of VBP and I am eager to see the full year results in March 2023. On the other hand, another major local listed competitor (Chunli Medical) priced its knee products too high in its bids and lost the tender - a major blow to the company which surprised many people. This loss from Chunli does show that nobody is ‘favoured’ in the rules-based VBP tenders, and that the VBP does force market participants to show their best hands and keep improving on its cost control and operational efficiency (of which local companies are much better than the foreign players). It will be interesting to see what impact it has on Chunli after losing such a key product group, and who will take over its market share. Another key metric to watch for will be how much more demand will come from the lowered prices, especially in this field where the surgeries can often be voluntary or optional. If the precedent of the coronary heart stent is any good guide (volume has increased by 1.8x of prior year after VBP slashed prices by 93%), the demand curve of joint replacement products may see similar trends (though other factors may dampen such uplift).

Other Evidences of Favourable Policy Directions

In addition to the above joint replacement VBP, there are other encouraging signs that the authorities are adjusting and tweaking the policy to be more reasonable. Some of the other key policy developments are:

In Sep 2022, the healthcare authotities have given the most clear indication that innovative medical devices will not be subjected to VBP, and encourage companies to continue R&D and launch innovative products (link here).

In Sep 2022, the latest nationwide spinal products VBP results showed an average price cut of 84%, slightly higher compared to the level for joint replacements but well within market’s expectation. Surprisingly, there was an additional qualifying rules that price bids which are <=40% of the “highest qualifying price” will automatically be qualified as winner. This further ensures there is a pricing floor and encourages more rational bids from competing companies. In addition, there is a new rule that stipulates a direct price-volume formula, which further helps to consolidate the industry and aids the largest firms to gain market share. Notably, due to the relatively large local brand market share, some of the reputable MNCs such as Stryker and Zimmer Biomet didn’t win the tenders while others like J&J DePuy have won only the limited volume, leaving a huge territory for local brands to gain market share (another example of “国产替代”).

After the 2 years of the national VBP for coronary stents expire, in Nov 2022 the authorities have extended the effective period for the existing winning bidders for another 3 more years instead of calling for another auction-like bidding war. This improves business continuity and operational certainty for the winners and removes much uncertainty from guessing which companies will win the tenders again. Notably, the guaranteed volume has also increased by 40% vs. last year, reflecting the increased volume usage from hospitals post VBP.

Importantly, the authorities have allowed prices of the coronary stents to be revised upwards, with an average increase of 20% across all products and largest increase of up to 70%, from RMB 469 to RMB 845 per stent. Furthermore, they have added the “伴随服务费” of RMB 50, similar to what was implemented for the joint replacement VBP. Though the absolute dollar increase is small (RMB 200-300 per stent), these policy developments further confirms that the authorities are not primarily driven by cost savings (i.e. price cuts), and wants the industry players to compete fairly and effectively while ultimately benefiting all stakeholders including the doctors and patients.

There are still more evidences coming from various provincial tenders carried out across the country (which are too many to name), and all of them have shown increasingly softer approach both in terms of price cuts and bidding rules.

Framework in Picking Winners in the Medical Device Industry

With all the dramatic regulatory changes and market reactions that were happening over the past few years, the implications are clear, in my opinion, that the medical device industry in China is still very much worth investing. Gone are the days where any fortune seeking, risk taking entreprenerus can just copy the foreign technologies and start selling medical devices or consumables to reap huge profits. Gone are the days where medical device distributors can earn decent margins leveraging on their networks and ‘guanxi’ with the hospitals and doctors. Under the current paradigm shifts underpinning the healthcare reforms and the normalized implementation of VBP across the industry, I believed there are a few key criteria to look out for in trying to pick winners from this industry:

The market sub-segment must be one that hasn’t fully gone through the import substitution phase (see point 2 from my post on AK Medical). I.e., foreign brands must still dominate at least 60-70% of the overall market, giving rise to the possibility for market share grab from local brands. The counter-example was the stent VBP which saw brutal price cuts and the corresponding painful drop in the sales and profitability of the companies, as the local brands already command 70-75% of the overall market for stents in China.

Within the local brands, the target company must be the top player (if not a close 2nd) in their respectively sub-segment - both in terms of scale (revenue, distribution network, hospital touchpoints) and product capability (R&D capability, clinical superiority and product range). This is not the same argument from the tech sector where network effects or other factors congregate to result in “winner takes all” scenario. This is important because it again increases the probability of winning any VBP tender bids, ability to gain market share in import substitution trend, and allows the more innovative, non-VBP products to benefit from gaining access to the top tier (三甲) hospitals.

The market sub-segment and target company should have a high GP margin (ideally >70%), and ideally should have the highest margin among the local brands (or same margin but lowest cost producer). This demonstrates the company’s economies of scale and operational efficiency (e.g., use of automation and robotics). This ensures a more competitive position in tender bids and a large enough room to buffer from unexpectedly high VBP price cuts.

The target company needs to demonstrate some track record and ambition in going global, and not just in emerging markets but ideally have product already registered (or in the pipeline) from EU CE mark or US FDA. This may seem trivial but it does demonstrate whether the company is more of a product-driven or sales-driven company, and also reflects pretty well the company culture and strength of the management team. Across many strategic industries, Chinese companies going global will be a key theme in the next few decades as China continues to grow economically.

All of the companies in my portfolio fits most, if not all, of the above 4 criteria, perhaps except for Peijia Medical (in no ways do I feel less convicted in Peijia vs. other 3 companies), which I hope to write about in future post.

A Test of Courage in Holding Contrarian Views

I am a keen reader of Howard Marks’ writings and his book “The Most Important Thing”. In the book, he talked about how superior investing requires two primary elements:

Seeing some quality that others don’t see or appreciate

Having it turn out to be true

In today’s world, information edge has largely been arbitraged away due to the ease of access and transparency of disclosure. I believe in the case of medical device industry in China, it is one of those scenarios where analytical edge and time arbitrage edge provide the opportunity to earn superior returns. Market participants have previously priced in such pessimism that the risk-reward doesn’t make sense anymore. People argue that the Chinese government regulations are too volatile and unpredictable after seeing the entire after school tutoring industry being decimated almost overnight. However, drawing parallels between that and the medical device VBP misses the big picture and the true intention of the government. Over the past few years, many fund managers and investors have avoided the industry entirely citing unpredictable tender results and that no company will benefit whereby its industry just arbitrarily got shrunk by 80% or 90%. It is with such a pessimism that share prices have drop to mouth-watering levels in 2022, which I gladly responded with more purchases (similar to how when Häagen-Dazs goes on sale, I buy more, not less).

I have definitely done step 1 from the above, and step 2 is clearly yet to be decided. It does take a lot courage to hold contrarian views, especially when you see the share price tanking. To be fair, I might be right about the industry dynamics after the dust settles but still be wrong about the company itself (poor management, eroding moat, etc.), which I hope that diversification into four different medical device companies, each a leader in their respective sub-segments, will help to mitigate this risk.

Ending Note

Lastly, thank you for reading this letter and I look forward to sharing more in my next letter. Meanwhile, feel free to reach out to me at hillope.capital@gmail.com if you have any comments or questions. I wish everyone a healthy and joyous 2023 ahead!

I will end this letter with the following Howard Marks’ quote:

“You can’t do the same things others do and expect to outperform… Not only should the lonely and uncomfortable position be tolerated, it should be celebrated… The safest and most potentially profitable thing is to buy something when no one likes it. To beat the market you must hold an idiosyncratic, or nonconsensus, view.”