H1 2025 Results and Thoughts

Days are long; Years are short

Dear Investors,

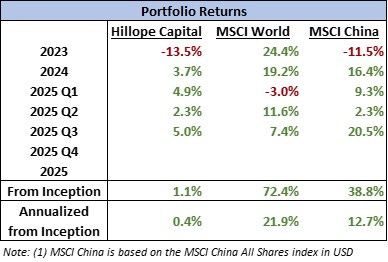

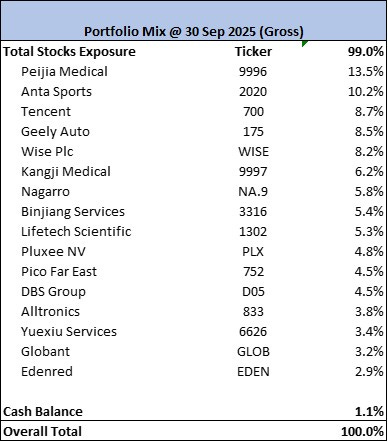

Below is the return summary for Q2 2025 (including dividends), as well as the breakdown of top holdings:

Key Portfolio Updates

During the six months from Q1 to the time of writing, I sold all holdings in Micron, Yihai International and PSBC, and initiated new positions in 2 small cap companies listed in Hong Kong (Alltronics HK: 833 and Pico Far East HK:752) as well as Globant, which is in the IT consulting space and a competitor of Nagarro - both of which were hammered heavily due to concerns from the impact AI on IT outsourcing spend.

Again, I want to share with you my thought processes on these actions I took, and hopefully through this process it will also clear up my mind and perhaps draw some insights as well into understanding the shortcomings of my decision-making.

On selling Micron, which I have held on for close to 5 years, the initial key impetus for my consideration to sell was that both Li Lu and Mohnish Pabrai sold their stakes in Micron in Q2 2023. I wrote about this back in my H1 2024 letter, but applauded myself for ‘independent’ thinking and not following the legends in selling Micron. However, as I read and analyze more into what’s happening in AI, it became clear that I do not have an edge over other investors in terms of understanding how crazy and how far the Big Techs will continue on spending on training AI models using brute force without justifying for ROI. In short, I feel that this is outside my circle of competence. The recent run-up in share price, investor frenzy over AI, and performances of memory players may not last long - how long it will last, I am not sure. But one thing I am sure is that Meta, Google and Amazon will not continue to spend billions upon billions of dollars on AI, without any considerations to the dollar returns on capex spend. To quote the kind of FOMO happening across Silicon Valley and Wall Street, Mark Zuckerberg said in a recent interview that “If we end up misspending a couple hundred billion dollars, that’s going to be very unfortunate obviously… but I think the risk, at least for a company like Meta, is probably in not being aggressive enough.” Particularly with the stunning rise of an alternative way of training AI models as evidenced by Deepseek, it became even more clear this won’t continue on forever. Coupled with the other uncertain factors (geopolitical risks and triopoly equilibrium breakdown with Samsung and SK Hynix), I do not feel comfortable holding onto Micron anymore and sold for a profit of ~1.8x or ~13% annualized return.

On selling Yihai International, I still do think the company is fantastic in terms of ROCE and the possibility of expanding beyond reliance on hotpot condiments. However, it became clear after a few quarters analysing the past margin trends that the founders are prioritising Haidilao’s margins, and rightly so, at the detriment of Yihai International. Yihai itself was born out of Haidilao as a side business and much of the brand value and marketing rode on the success of Haidilao. Hence, the GP margins that Yihai sells to Haidilao fluctuates wildly and it is too difficult to determine the value given the reliance on the related party transactions for the foreseeable future. With such uncertainties surrounding the core business of hotpot condiments (though I believe Haidilao globally will continue to grow at 5-10%), coupled with the uncertainties on the growth of ready-to-eat products (mainly self-heating packaged products), fierce competition and continued deflation in China, I became much less comfortable with how the business will look like in 10 years time. Even though the dividend yield is a good 6%, I decided to sell Yihai and invest in other companies with a superior margin of safety. If I want an exposure into the brilliant culture of Haidilao, I may at some point own Haidilao directly but F&B has always been a tough industry for me (I’m closely monitoring the ex-Haidilao brands’ growth).

On selling PSBC, which I have held on for 4 years, I initially bought the stock cloning Li Lu and was convinced about the structural advantage that PSBC has in terms of the cooperation with its parent company China Post. However, Li Lu started to trim its holdings back in Q4 2024, and that again prompted my re-examination of the company. Essentially, I still believe that the Company has decent return prospects coupled with stable cash dividend returns. It has high probability to continue growing at 5% for the next decade, and with dividend yield at 5-6%, coupled with operating efficiencies to be unlocked from non-interest income (investment banking, cards, wealth management businesses, etc.) should provide another 2-3% increase in margins - hence providing a good 10-15% IRR over the next 5 to 10 years (which can potentially be higher if there is multiples re-rating). However, the key uncertainty for me is that over the holding period in the past 4 years, I can’t see any improvements from the management team in terms of shifting more focus to unlock the non-interest income business (the high FD savings rate continue to become a drag on the overall ROE, though they are acquired at a huge cost advantage due to the extensive branch networks of China Post). It then became clear that unlike other profit-driven banks elsewhere, the Chinese government has many other political and social agendas in mind, and maximising profit is not the priority (though this implicit backing from the state also offers it stability that other private, profit-driven businesses will not have). Coupled with this heavy regulatory mindset, my lack of understanding of the management team and CEO (which can be changed in any case due to internal rotations) and the fact that China Post can impose different agency fees, it is almost impossible to determine if the bank will ever move closer to maximise its full potential. At the same time, I found another company with much better return prospects - Geely Auto, and hence decided to sell and move over to Geely. If there were not other stocks I have in mind at that time, I would have held on to PSBC since it will be better than cash or T-bills.

New Position Write-up: Wise Plc (“Wise”)

I first got introduced to TransferWise (as Wise was previously called) from social media (Richard Branson was advocating for it as he was an early investor back in 2014), and I later became a customer of Wise as I needed to transfer money at a low FX rate, and now I am proud to say Wise has become my go-to option whenever I travel overseas for vacation. It first caught my attention after I noticed how obsessive the company is towards building its products, and how hassle-free the whole customer service process is (you feel a bit like talking to your friendly aunt than a cold profit-seeking corporate).

Founded in 2011 by Kristo Kӓӓrmann and Taavet Hinrikus, Wise’s mission is to make money flow freely without borders, making international transfers cheap, fair and simple. Simple and clear Company mission statements are typical hallmarks of a great company. As with all great founding stories, it all began with the founders’ own frustrations with the incumbent cross-border transfers, and decided they can do it better.

Typically, the traditional chain of communication between banks is called correspondent banking. The banks are reliant upon a global organization called Society of Worldwide Interbank Financial Telecommunications (SWIFT) for communication. It is a member-owned cooperative connecting more than 11,000 banks, financial institutions and corporations in more than 200 countries. It is essentially an electronic communication network that tries to put in place a common language and some standards around how cross-border transfers work.

Under the SWIFT model, for a $1,000 transfer across borders, a multitude of banks may need to communicate and reconcile and verify and confirm that the transfer has actually taken place. As each transfer cycles through numerous correspondent banks, fees compound on top of each other and waiting time increases. The World Bank has estimated the average remittance cost globally at ~6.5%. Furthermore, incumbent financial institutions have exploited the lack of cross-border substitutes and opaque process to charge exorbitant ~2-4% markups on exchange rates, oftentimes as a façade for hidden fees.

What Wise does differently and wisely (no puns intended) is that they arbitrage the broken system and money never crosses borders in a Wise transfer. Essentially, it maintains an entire network of bank accounts that they own, and transfers happen between the customers and Wise’s bank accounts locally. For example, if Person A needs to transfer $1,000 USD equivalent to India from the USA, Person A sends money to Wise’s USD bank account in the US (after deducting fees), while Wise’s Indian bank account transfers IDR, at an agreed rate known to Person A when the transfer was made, to the recipient account in India. In order to scale this, Wise has established liquidity pools (local holdings to facilitate currency conversion) in various countries. The key value proposition and why the company managed to scale so quickly and loved by many customers are that Wise is 10x cheaper than the legacy alternatives and much faster, while also being incredibly transparent with the pricing.

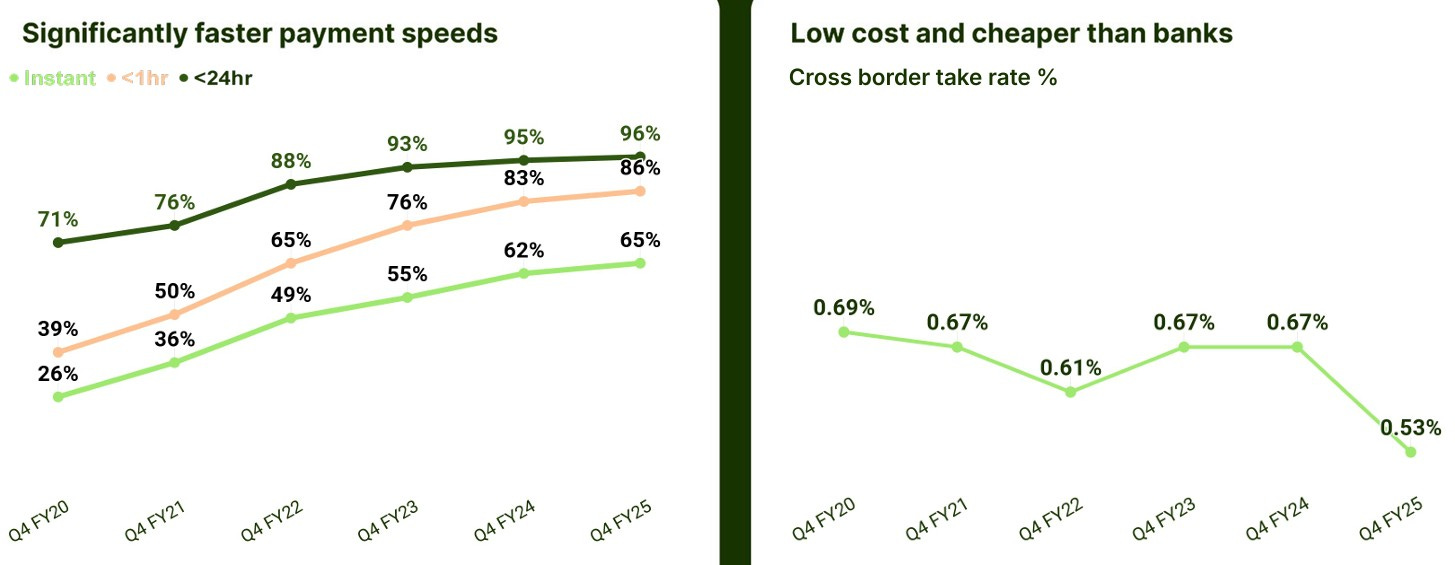

It is amazing how laser focus Wise management team is on its mission - cheaper (any increases in fees they will work hard to pass onto their customers), faster (this beautiful chart below says it all). They believe strongly that advancing these core missions will benefit the owners of the Company (it’s interesting the Company called their IR page Owner Relations, not Investor Relations).

Wise’s Revenue Model and Operations

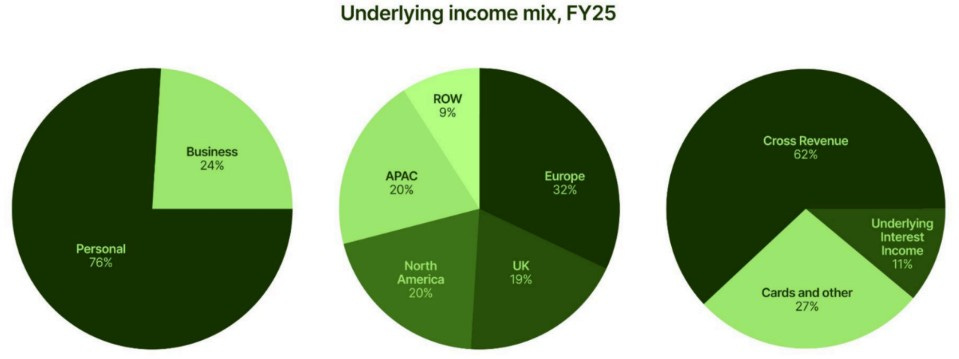

Wise’s primary revenue comes from transfer fees charged on foreign exchange transactions. Rather than a flat fee or high percentage fees, Wise uses a low, transparent fee plus the real mid-market exchange rate. The more volume of FX transfers that happened on Wise, the more revenue it gets. In terms of customer breakdown, as of Jun’25 quarter, c.95% of the 9.8 million users are personal customers contributing 79% of cross-border revenue, while c.5% is business customers contributing 21%. For the trailing twelve months to Jun’25, there was a total cross-border transfer of £153 billion, generating revenue of £844 million (c.60% of total revenue), implying a take-rate of 0.55%.

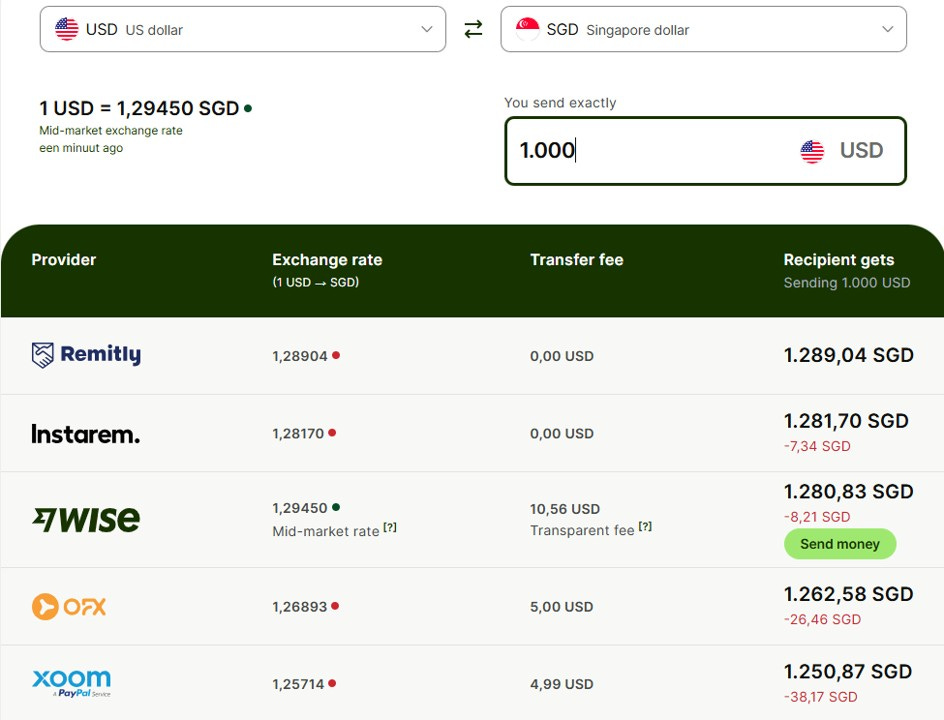

To give a sense of Wise’s transparency, they have created a comparison page that allows users to input the currency pairs, and the webpage will calculate and list the amount of fees they charge vs. what the competitors charge, and very often Wise is not the cheapest, but generally becomes the case when the transfer amount gets large (e.g., USD 10,000) - such transparency deserves applause, since when have you ever encountered such an honest and transparent salesperson.

Wise also offers a multi-currency account (“Wise Account”) for individuals and businesses, allowing users to hold balances in 40+ currencies, spend with a Wise debit card, and receive local bank details in various countries. Revenue streams under this segment include (i) card interchange fees (paid by merchants to Wise to payment settlement), (ii) currency conversion fees if the balance is not enough for payment, (iii) ATM withdrawal beyond certain monthly thresholds, (iv) one-time physical card issuance and replacement of cards, and (v) other miscellanoues services. The Wise Account and debit card offering set Wise apart from traditional banks by providing borderless banking functionality via a fully digital platform, which helps to drive customer retention through its added utility and ease of mind knowing that the FX rates are always fair. As of Jun’25, customers hold under their Wise Account a total of £18.1 billion, and generated revenue of £394.8 million for the trailing twelve months.

With such a huge amount of customer deposits, Wise has in recent years unlocked a new revenue stream - interest on customer balances. Wise typically invests the customer deposits into safe instruments such as money market funds or government bonds, and earns interest on these funds. As interest rates rose, Wise’s interest income surged, especially in an inflationary environment. To demonstrate another example of fairness and transparency, Wise has publicly shared with investors its ‘interest income framework’ - to retain all income under the 1% yield (and classified as “underlying interest”), and only 20% of interest income above the yield (“excess interest”), with the rest being paid to customers. For the trailing twelve months, this underlying interest income amounted to £160 million. To generate higher return for its users, Wise has in selected countries introduced a new product feature called “Wise Assets”, which allows customer to opt-in for higher return instruments - Stocks (by investing their deposits into low fee index tracking funds such as MSCI World Index), or Interest (by investing into interest earning funds).

Another important revenue stream is Wise Platform, the company’s white labelling offering, which allows banks (e.g., Stanchart, Morgan Stanley), neobanks (e.g., Monzo, Nubank), brokerages (e.g., Interactive Brokers, Moomoo), and other fintechs (e.g., Ramp, ProSpend) to integrate Wise’s international transfer infrastructure into their own services. Through API integration, partners can offer low-cost, fast cross-border payments to their customers, powered by Wise behind the scenes. For Wise, these partnerships expand its reach without heavy direct customer acquisition costs, and over 100+ partners have joined Wise Platform. Integrations with these customers range from simple cross-border transfers behind banks’ proprietary interfaces, to API connections, to full-fledged integration with Wise’s payment rails with the customer’s own KYC checks. Revenue is generated by sharing fees with partners or charging the partner institution. Platform volumes currently stand at 4% of the total, with management expecting this figure to rise to 10% in the medium term, and ultimately contribute up to 50% of overall volume.

Wise’s Moat and Investment Thesis

Solving a real pain point in a huge TAM - Anyone who has tried to optimise their dollars when doing FX conversions will feel the pain and opaqueness in the entire system. In my opinion, over the years Wise has successfully built the level of trust among consumers who feel confident that they will be getting a good deal from Wise, being one of the lowest cost FX providers in the market. Countries will continue to use their own currencies (the integration of Euro has been fraught with issues and debates are ongoing up to today on whether it is net positive or negative for Europe). Currently, the total volume of cross border transfer globally is estimated to be c.$40 trillion, and broken down into 10% (personal) and 40% (SMEs) and 50% (Enterprises). Several sources, including FXIntelligence and McKinsey, indicate that c.70% of such cross-border payments are still processed by traditional banks. That’s a whopping $28 trillion (70% of a $40 trillion market) handled by expensive, opaque, and slow incumbents! As a comparison, Wise handles an annual volume of £153 billion (or c.$205 billion), which by itself looks like an enormous number, but only represents <1% of the addressable market - that’s a massive opportunity. It seems only logical that a significant portion of these flows will gradually shift to more transparent and efficient providers. While this doesn’t seem like a winner-takes-all market, even a conservative 5-10% market share for Wise (bearing in mind the Wise Platform) would imply a potential 10-20x increase from its current level. The bottom line: as long as currency conversions and global trade remain, and Wise continues to offer the most cost effective and fast transfers, Wise is well positioned to grow volumes at double-digit rates for years to come.

Network effects and ecosystem advantage - After many years working with many banks and institutions globally, Wise has built up a network of ecosystem players - directly connecting to six countries’ domestic payment systems (and growing), with over 90 banking and payments partners across 160+ countries and 40+ currencies. More importantly, one of Wise’s moat lies in its ability to connect directly with nations’ government-supported domestic payment systems, obviating the need for bank partnerships. These instant and real-time settlement systems are the pinnacle of domestic payment rail integration, offering a near-instantaneous payment platform organized by the country’s government or central bank (e.g., FAST in Singapore, PromptPay in Thailand, DuitNow in Malaysia). Being integrated directly into such payment gateways allows a firm to circumvent the latticework of domestic payment rails while remaining connected to virtually all domestic bank accounts. However, such integration is an arduous process as global payment systems are heterogeneous, and local expertise is required throughout each market, which Wise has successfully integrated. In essence, Wise has created a typical moat of network effects, where consumers or banks prefer to get on a platform with more currencies that get transfer done cheap and fast (any incumbent will struggle to offer similar service level given the liquidity and infrastructure requirement). The more consumers come on board, the cheaper and faster the FX transfers will be, attracting even more consumers. As long as Wise continues to execute on this flywheel network effect, then it is very hard for competitors to dislodge its moat.

Obsession with Mission Statement - if you read Wise’s investor materials, you will be amazed by how much the ‘Company’s Mission’ is talked about. Wise, under the leadership of Kristo, has built a strong corporate culture that is long term oriented, customer obsessive and laser focus on its mission. Although Wise doesn’t break out marketing spend in its statements, we understand that the amount is minimal for a fintech and remittance company. Instead, Company relies on word of mouth with an estimated c.65-70% of new customers acquired through referrals instead of paid advertising, which means a super low customer acquisition costs (CAC). The remaining new users come via online marketing, partnerships, and organic search. In essense, management believes that the best marketing is offering the best product so that the existing customers can spread the word like an evangelist. In fact, sometimes the Company’s obssession with lowering cost have upset many institutional investors, who feel that the Company is giving up too much profit margins. This is music to the ears of the long term investor.

Founder led with strong alignment - The Founder Kristo is not only laser focus on its mission, he himself has a c.16% stake in the Company. Kristo has demonstrated to have long term thinking, customer oriented instead of profit driven, and created a strong corporate culture. With all these factors aligned, it will be likely that the Company continues its current growth trajectory, and I’m excited what Kristo and his team can achieve in the future.