The Most Important Traits of a Great Investor

Welcome to my first post!

In this post, I want to share with you my thoughts on what makes a great investor. Given that in the investment management business there are indeed many different ways to skin a cat, what I want to focus on is what makes a great stock market investor. I believe a great deal has been written about this topic in one form or another, be it in books, annual letters, blogs or interviews, but somehow I find myself not able to distil into a few core ideas or a guiding framework. This post is the result of my attempt to answer this question, in the hope that it can be easily remembered and serve as a guiding framework for the never-ending quest to be a better investor.

First and foremost, I want to allude readers to the keyword in the title of this post – traits. By definition, a trait means some quality or characteristic that a person possesses, and it is behavioural in nature. In my opinion, what truly separates the great from the good in the investing game are not skills (as in mastering the perfect golf swing), not know-how (as in learning a secret Bolognese recipe that nobody else knows) and not even talent (as in having a photographic memory), it is a combination of traits that a person possesses which will ultimately, over a long period of time, determine how successful is the investor. Most investors know the strategies or principles that underlies value investing. I am sure most investors can regurgitate with precision many timeless quotes by the Sage of Omaha such as “be fearful when others are greedy, and greedy when others are fearful”, or “It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price”, etc. We all know them but it’s damn bloody hard to do them. It is obvious to me that traits are precisely what will help an investor to do them well. This is because having some particular desirable traits determine what actions an investor takes during market euphoria or panic, whether he stays within his circle of competence while constantly widening its boundary, whether he holds on to the winners or sell too early, whether he consciously tries to avoid misjudgement and biases, etc.

“A lot of people with high IQs are terrible investors because they’ve got terrible temperaments.” – Charlie Munger

“The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.” – Warren Buffett

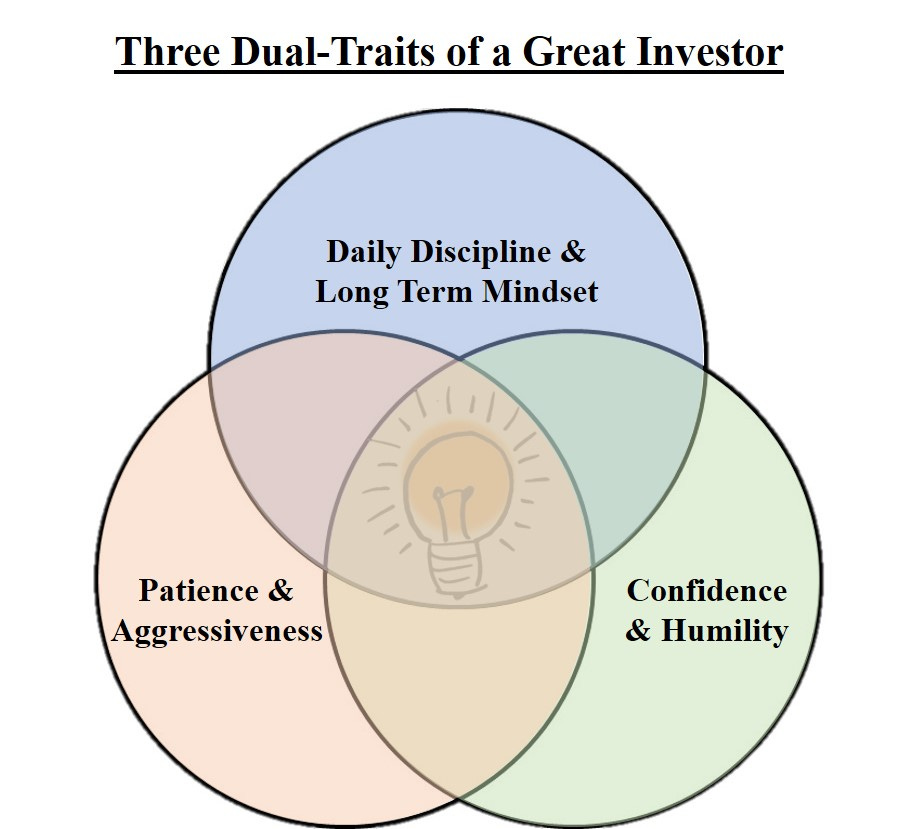

Before I go into what I think are the most important traits of a great investor, I want to introduce the concept of ‘dualism’ in investing. By dualism I mean having two seemingly opposing but complementary qualities at the same time. It is akin to the Yin (阴) and Yang (阳) in the ancient Chinese philosophy. Having too much of one element without the other is not ideal and often leads to bad outcomes. The key is to find the right balance between the two elements and I believe this concept applies equally well in investing. While there are many counterintuitive behaviours that each investor has to grapple with on a regular basis, for me by far the most important ones that I strive to keep working on finding the right balance are the following three conflicting but yet complementary dual-traits:

Patience and Aggressiveness

Confidence and Humility

Daily Discipline and Long Term Mindset

I shall delve a little deeper into what I meant for each of the above and provide some thoughts.

Dual-Trait 1: Patience and Aggressiveness

Most investors understand the importance of patience in stock markets. In essence, patience requires inactivity. Patience means letting time be your best friend. I believe there are three key situations where patience demonstrates the utmost value:

Prior to investing and waiting for the perfect pitch right in your strike zone;

After investing and waiting for your thesis to be proven; and

After investing and letting it compound for a very long time without interrupting.

I suspect most people may viscerally associate the idea of patience to the first situation, but I think the second and third situations are equally important, and require no lesser amount of patience to achieve them. This association may well be expected since the first situation is what most people experience easily (e.g., bought too early, chasing the momentum, demanded less margin of safety, etc.) and the feedback loop can be very fast and hits the investor hard. Patience in the first situation will often allow a good margin of safety which is an important first step in achieving great results. However, for an investor it is important to bear in mind that excelling in patience for the first situation alone is not enough to yield the great investment returns over a long period of time. If anything, one may argue that among the three situations, patience in the third situation, or the lack thereof, will have the most impact to your portfolio returns over a long period of time. Although I haven’t had the luxury of time to ‘prove’ the third situation with my own portfolio, numerous great investors have often said that one of their biggest mistakes is selling winners too early.

After talking about yin (patience), it is equally important to talk about yang (aggressiveness). To me, there are two key areas of aggressiveness in investing – strike big when the odds are in your favour, and sell without hesitation when the investment thesis changes or you find yourself committed a mistake. I think both are equally hard, and the key to achieving them are confidence (more about this later) in knowing whether your thesis is right or wrong, and removing emotions out of the markets.Indeed, how many times have you heard people saying that they have lost half of their investments in a stock but, for no good reasons, just want to hold on to ‘recoup’ the losses? People mistakenly judge that by not realizing a loss position it somehow does not become ‘real’. Loss aversion bias can really muddle a rational mind. The market doesn’t care what your entry price is and it doesn’t always have to mean revert. The question I always pose to them is: “If I give you the same amount of money as you would have by selling the stock, would you take the money to buy it again having known what you know about the stock and all the opportunity costs?”.

Dual-Trait 2: Confidence and Humility

By now it should be evident that the three ‘dual-traits’ I mentioned above are somewhat inter-connected. For example, you need confidence in order to be aggressive when market panic sells, and you need confidence to hold on and be patient while waiting for your thesis to be proven by the market. However, blind conviction can be lethal. You need to have confidence and be right. The being right part of the equation means fully understanding the business and industry dynamics, doing the detailed research and analysis, thinking deeply and widely about the company’s moat and future earning power, etc. One question I always ask myself: “How do I know whether my confidence is well-warranted or half-baked?” This is a tricky question and I don’t have a good answer. It is tricky because unlike in competitive sports or other skilful crafts, you know you are good when you beat your competitor or when most of your audiences love your performance. In investing, you can make the wrong decision or have false confidence but yet the market rewards you (or vice versa). The feedback loop is not direct and often can be misleading. On a short timescale, it is hard to attribute whether great investment performance is due to luck or skill. This is why a minimum of at least three to five years of track record is needed to judge an investors’ proficiency. The self-awareness needed to critically evaluate the question of whether your confidence is well-warranted is something that improves with time.

On the other side of yin-yang balance is humility. To me, humility means being open to many different views (especially an opposing view), always strive to be a learning machine, always seeking out the truth and admitting your own mistakes. I am a strong advocate of humility and believe being humble will lead to many good things. It helps you to keep emotions and ego in check, helps you to stay rational and focus on what is important, and helps you to stay within your circle of competence. If an investor wants to outperform the market, by definition you have to be contrarian and right at the same time. Humility is what helps you to increase the chances of being right.

When people describe the quality of others, it is seldom described as both confident and humble. This is because both qualities are at odds with each other. If I had to choose between the two, I would rather have humility than confidence. This is because the former reduces unforced errors, loss of capital and allows compounding to work its magic while the latter will contribute more to making you from good to great.

Dual-Trait 3: Daily Discipline and Long Term Mindset

On daily discipline, as with investment gains, it serves well to keep reminding myself the power of compounding. 1% better every day will lead to 37.8x better after a year. Although this may seem like a cliché quote from a self-help book, but no doubt it is a powerful illustration of compounding. To me, the keywords in that quote are not the numbers, but the three words “better every day”. It doesn’t matter how much better (for that matter it may not even be quantifiable), be it 1% or 0.1%, but the important thing is the direction and the discipline to keep doing it every single day. To me, being better every day means learning something new or being a little wiser every day.

“Spend each day trying to be a little wiser than you were when you woke up. Day by day, if you live long enough like most people, you will get out of life what you deserve.” – Charlie Munger

Daily discipline is tough in investing because when it comes down to the day-to-day activities, investing is just miles away from being an exciting sport. Warren Buffett has famously said that he spends an estimated 80% of his working day reading and thinking. It is this seemingly “sit there and do nothing” activity that information gets internalized, knowledge gets compounded and occasionally an investment insight can be found. Often times I find myself spending hundreds of hours researching and thinking about a business but in the end didn’t managed to pull the trigger. It is easy to fall into the trap of action bias, thinking that all the efforts and hours of research are ‘wasted’ if I do nothing. The truth is that all the knowledge and research, if well thought through and synthesized, gets compounded and eventually expands your circle of competence. Daily discipline means the ability to resist all the market noise, macroeconomic news, daily price fluctuations, and to focus on what is important – getting better every day.

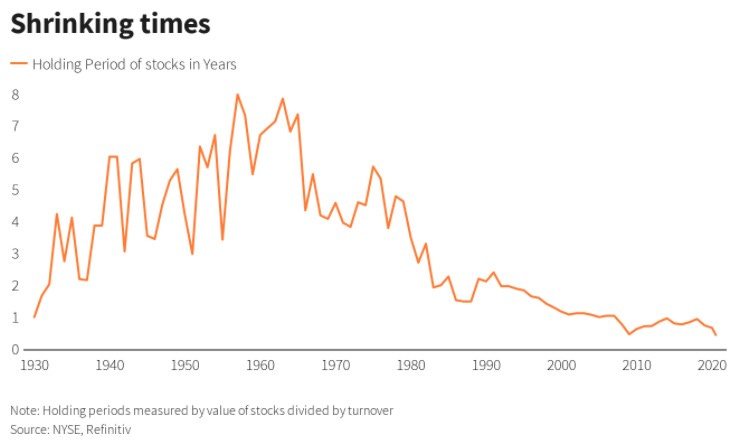

In today’s investing world, I truly believe that having a long term investing mindset is a major competitive advantage. Looking at the decline in average holding period of stocks over the past decades and the 52-week highs and lows of the largest S&P companies in any given year, you will have no doubt that most market participants do not operate with a long term mindset. So why is long term mindset so important? Because it forces you to ask the most critical questions that underpins the long term intrinsic value of a business. A long term mindset helps you to make the right decisions easier. Will the company’s earning power be significantly better in 5 to 10 years? Are you comfortable buying the stock if the market closes tomorrow and re-opens 5 to 10 years later? Daily discipline with a long term mindset will help an investor zoom in on the most critical questions that matter.

Perhaps the best analogy of this dual-trait is that of a marathon runner who does not know the finishing line. If you tell anyone to keep running every single day but doesn’t tell him where the finishing line is, I wonder how many people will start running. That is why long term investing is so difficult. That is why you have to be more interested in the process of reading and thinking (running), and not only the pot of gold at the end (the finishing line).

Concluding Thoughts

You may wonder, for each of the dual-traits, what is the right balance for you as an investor? For that matter, what’s Warren Buffett’s right balance? Should you try to figure that out and just emulate his balance? The answer is obviously no. This is because each person’s right balance is different. Each person is born with a different set of DNA, different experiences and upbringings, influenced by different schools of thought and hence have varying disposition in each of the dual-traits. For example, for someone who is born to have patience and enjoy ‘watching the paint dry’, his right balance may well tilt heavily towards the aggressiveness scale.

This reminds me of an analogy from physics. In thermodynamics, the triple point is the temperature and pressure at which solid, liquid, and vapor phases of a substance can all coexist in equilibrium. Each substance has a different triple point, for example, for water it is ~273 Kelvin and ~612 Pascal while triple point of hydrogen is at ~13.8 Kelvin and ~7 Pascal. Similarly, to achieve the right balance of yin and yang in investing, there isn’t a fixed ideal balance for every investor. The ‘triple point’ ought to be different for each investor based on his or her DNA make-up and cumulative experiences.

So in conclusion, there they are, the traits that I feel are most important in the path of being a great investor. This is the framework that guides my thinking and actions, and one where I constantly strive to find my own ‘triple point’ among these three dual-traits as I continue rolling my snowball journey along the slope. Hope you guys enjoy this post, comments and thoughts are more than welcome!