Q2 2023 Results and Thoughts

Dear Investors,

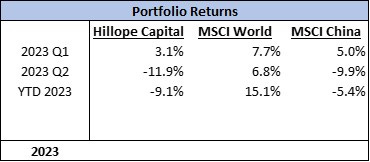

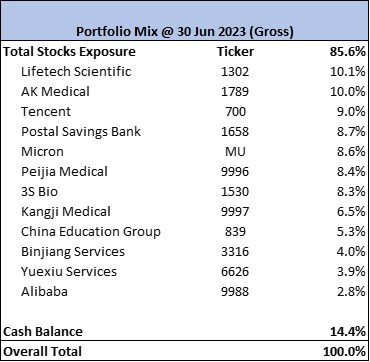

Below is the return summary for Q2 2023, as well as the breakdown of top holdings:

Key Portfolio Updates

During the quarter, I have gradually added to four of my existing positions - Postal Savings Bank of China, Lifetech Scientific, Peijia Medical and Binjiang Services.

On PSBC, I continue to believe that the bank is uniquely placed among the various large state-owned banks in China to differentiate itself and continue to deliver better than expected growth. Banks have for a long time been undervalued in China due to various reasons, but the investment in PSBC is not a bet on the eventual multiple re-rating of the banking sector, but rather on the growth and steady earnings power of PSBC for the foreseeable future. Key theses remain as follows:

Unique business model with China Post Group allows it to reach places far and in between in the remotest area of China where no other banking players have a geographic reach that come close.

Strong and much cleaner balance sheet without the historical burden (and hence bad debts) of other state-owned banks (though some people believe that this exposes PSBC to do national service in the current times of economic turmoil, I doubt it will comparatively do more than other state banks, if at all).

As interest rate rises or normalizes, the bank’s agency fee model will benefit its earnings, while Post Group has the incentive to help the bank push more retail oriented and wealth management products, ultimately earning a higher ROE as the bank continues to execute on its strategy.

Structural moat in terms of large and low cost customer deposits in the form of personal time deposits which is still largely untapped, and should gradually be used to provide a higher interest margin spread going forward.

One of the key risk facing PSBC is definitely the property crisis currently unfolding in China, and it is hard to see how it will unfold. I believe the CCP government has both the willingness and policy tools to stablilise the crisis, but again over the past 3 years we have witnessed some quite unimaginable things that had happened in China. Nevertheless, with a >6% dividend yield and a long term consistent earnings growth of 8-12% p.a., I regard this as the safest investment in my portfolio.

On Lifetech Scientific, I haven’t written too much about this company but it is one that I have followed for the longest time. Suffice to say, the H1 2023 results are a little disappointing but the real gem in this company lies in the pipeline products that are expected to be commercialized in 2024/2025 (IBS, aortic arch stent graft, G-Branch TAAA stent graft, mitral valve clip X-Clip, etc.) and the progress it has made in going global - sales from overseas grew at 34% YoY and now constitutes 20% of overall sales. Sales from pacemaker segment was disappointing with a 25% drop YoY due to the VBP (集采) - this is something to monitor and see how they fare against the competitors from Microport and Lepu.

On Peijia Medical, I have added to my position sizing in Q2 2023 as I believe they have one of the best R&D and execution teams in MedTech companies in China. Key risks to watch out for will be the more than expected cash-burn in Q2 2023 (though some of it are due to BD milestone fees, of which the committed balance is now only ). There seems to be no signs of cost-cutting or slowing down given they are firing all engines on a range of clinical trials and R&D developments, which inevitably means spending more money. A key development is that the neurointerventional segment is close to breakeven as it continues to scale up, but the valve business looks to be spending a lot of sales and marketing dollars to gain market share (but the positive is that they have been gaining % market share). With the recent anti-corruption drive raging across the healthcare sector, this is a clear landmine risk that may have severe impact on the company. I hope they can pace themself and get to net positive cashflow before they run out of cash (which I am sure they can raise funds but at such depressed valuation it is value destroying).

Perhaps it is worth mentioning here about the recent devaluation of the entire industry as people now believe they have made a mistake in their assumption of the explosive growth in the surgical volume of TAVR, citing affordability as the main reason. I find it hard to fathom that cost is really a factor here at play, given that the benefits of TAVR over SAVR are huge (in terms of less trauma, less complication risks and better post surgical recovery) as well as psychologically more appealing (a small puncture at your femoral artery vs. an open heart surgery with a heart-lung (bypass) machine). The penetration rate of TAVR will increase steadily in the next 5-10 years as more clinical data supports the indications for “low-risk” patients. With a civilisation that is well-known in its culture to over-save for the rainy day in general but over-spends in proportion on education and healthcare, it is hard for the children to not opt for the best treatment for their parents when they are making a decision over SAVR vs. TAVR (even for low-to-mid income families in China). Even if the affordability issue is partly true, with the treatment now increasingly being considered for medical insurance reimbursement, this cost consideration should carry less weight going forward. I believe the key impediment now is more on lack of number of skilled surgeons being able to carry out a TAVR (and of course the 3 year Covid hiatus and all the regulatory chaos have definitely delayed this trend), which will also be improved given the incentives that drive both the doctors and the TAVR companies.

On Binjiang Services, I hope to write a separate post on it at some point but suffice to say, the key theses for me in investing in this real-estate related industry are that:

Industry wise, there should be gradual decoupling of valuation between property developers (the ParentCo) and their property management subsidaries. Market hopefully will realize that disparate business model, consistent and stable cash generating capabilities of property management companies, especially for those with strong growth in GFA under management from 3rd parties.

Binjiang is positioned at the premium market with many luxurious properties under its management and the Group has the largest market share by sales in residential property in Hangzhou by a large margin (~2x the next competitor in Hangzhou). Strong branding, good reputation, quality customer service and strong execution of management team provide the moat that allows the company to keep increasing the property management fee charged (raised fees 45 times since 2015) and the high per square feet property managment fees of RMB 4.3 psm per month (vs. National average of RMB 2.3 and Hangzhou average of RMB 2.7).

A key risk for property managemenet company is whether its ParentCo will siphon its cash away or the property crisis may drag down the entire group given a large proportion of the GFA growth still relies on properties built by its property development parent. I believe its parent company Binjiang Group is relatively safe among the private property developers and should be more shielded from the downturn than many of its peers. Furthermore, from the track record and actions of the management so far, it does seem to suggest that the boss 戚金兴 and 朱立東 are both long-term oriented and cares about its employees and shareholders.

Continued growth from expansion outside of Hangzhou into the neighbouring metropolitan cities in Zhejiang Province, and the Group’s growth strategy into project management business (代建) should continue to provide ample growth for Binjiang Services in the foreseeable future.

That’s it for this quarter! Thank you for reading. Please leave a message if you read until here, it will help provide some motivation for the next post.

Great to see you writing again!