Q1 2023 Results and Thoughts

Dear Investor,

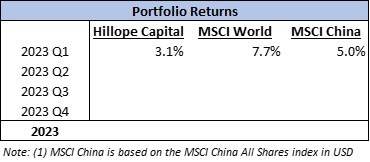

Below is the return summary for Q1 2023, as well as the breakdown of top holdings:

I do not pay much attention, if any at all, to quarterly return performance. The benchmark for me, or indeed for any long term investor, should be a rolling 3 year performance target. I would urge everyone, especially myself, to start paying attention to the returns table only in Q4 2025.

During Q1 2023, not much has changed during the quarter, except for slight additions to the existing positions Yuexiu Services and Peijia Medical.

Yuexiu Services experienced a sharp drop in stock price of 20% after they reported their full year results. The results were mediocre but nothing disastrous, but the real killer was in the disappointing dividend payout despite good operating cashflow and a huge cash pile, which investors reacted violently. To me, the intrinsic value hasn’t changed much and hence I added to the position after the drop.

As for Peijia Medical, I am continuously amazed by the vision, strategy and execution capability of the management team. Although the company is still loss-making as they are running full speed on many fronts to commercialize their pipeline products and spend marketing dollars to gain market share, the cash on the balance sheet should still be sufficient for at least another 2.5 years, by which the company should start to breakeven or even generate free cashflow. Despite a relatively large holding position to begin with, I continue to see divergence between the share price and its intrinsic value, and hence I added to the position. Among the fiercely competitive TAVR segment, I believe they are most likely to emerge as the leader among the three listed TAVR players. I can’t wait to see their progress in the coming year.

Some Thoughts on Macro and China

As I am writing this post heading towards June 2023, Chinese equities have once again pull back sharply from its short-lived recovery since November 2022. Geopolitical tensions, macro-economic pressures, faltering domestic recovery (among other factors) have all led to investors, particularly foreign investors, to pull their money out of China once again. This sounds all too familiar as investors start to question again if China is ‘investable’ or not. Pessimism has once again permeated the psychic among investors, be it retail investor or professional fund managers. I have no crystal ball into the future and do not typically spend much time on trying to understand or predict any macro-economic or geopolitical events.

What is clear to me, though, is that we are sitting at the start of a prolonged clash between two superpowers, something which the world hasn’t seen in decades. I believe the ‘Cold War’ between Soviet Union and USA has a different parallel to the current situation - China’s share of the global economic pie is much larger, the world’s supply chain is much more integrated and trade volume much higher, conflict is centred more around technology in addition to military, and most importantly, China is not looking to impose its communist way of governance onto others, etc. If anything, the geopolitical tensions between the two countries will not get better, and the world has a lot at stake to make sure both of these two countries do not spiral into an outright conflict.

Having said that, I also believe much of how this conflict will turn out to be relies more on the Chinese side than the US side. And so far my belief is still that the Chinese government wants to behave rationally and economic stability should be a key part of their calculation. Although my innate ‘gut feeling’ being a long term value investor is to presume that '‘this too shall pass” and investors have overshot as the pendulum swings to the extreme pessimism end of things (to borrow Howard Marks’ analogy), it is still difficult to ignore the lingering doubt that maybe this time it’s different. What is the most worrying to me this time round is the loss of investor or enterprenural confidence in the country, which can take a long time to reverse. Words need to be backed up by actions and I hope more concrete actions can be taken.

With the macro backdrop, it can be a challenging environment for investors. What is assuring is that the companies in the portfolio are companies mainly serving the domestic Chinese market (except arguably Tencent and Alibaba), with little exposures to wider geopolitical events (though are definitely subject to the constantly changing internal regulatory environment). I believe the Chinese government still have quite some ammunitions in its bag to counter any financial or economic warning signs, but whether they choose to do it before it is too late, nobody can be sure. Only time will tell.

Ending Note

I would very much prefer to write a more formal letter with an in-depth analysis into one of the portfolio holdings, but due to my work and family commitments I have found it much more challenging to devote more time on Hillope Capital. I shall try to write more in my Q2 2023 letter. Thank you.