Full Year 2023 Results and Thoughts

Patience, my friend, Patience ...

Dear Investors,

Due to my slothfulness and your patience, I have only been able to write about the Q4 2023 letter until now. Another reason for such a delay is that I wanted to wait for the release of all the annual reports for my portfolio companies before writing the letter (reason which will become apparent below), though obviously I am not using that as an excuse. I will try to work on my Q1 2024 soon.

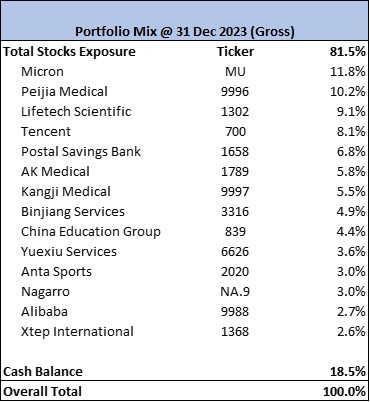

Below is the return summary for Q4 and the full year 2023, as well as the breakdown of top holdings:

My first full year of tracking PnL performance has been nothing short of a disappointment, considering the huge underperformance of almost 37% between Hillope Capital vs. MSCI World. Comparing to MSCI China index, it does not make me feel any better knowing that the gap between Hillope Capital (which has 2/3 of its AUM concentrated in Chinese companies listed in HK) and that of MSCI China is merely 2%. In fact, it hurts or embarrasses me even more since for some astute readers it may occur to you that I have somehow managed to track the worst performing country index to invest in while watching other investors raking it in betting on US, India or Japan. For me, the judgement of whether I am a good custodian of your money (and most of my money) should rest on an absolute yardstick vs. all easily accessible low cost index funds that track the developed markets (Dow, S&P500, FTSE100, HSI, Topix, etc.), since I could have well chosen to buy stocks in these markets but I chose instead to concentrate in China. Rest assure that this is not borne out of some warped inclination to be a ‘contrarian’ investor, but rather trying to be as rational as possible while acknowledging the risks involved.

Nevertheless, a single year of result mean nothing for me and hopefully for anyone serious about compounding wealth, though Chinese stocks have languished significantly against the peers for the most of past 3 years (ouch!).

The Basic Tenet of Value Investing

Any investor who has longed China stocks in the past 3 years will tell you how miserable it has been. Since the peak in Feb 2021 the HSI index has fallen more than 45% as of Dec 2023. Pessimism about the Chinese stock market and/or the Chinese ecnomy become almost unanimous and even some long term China bulls threw in the towel. Commentators can easily cite multiple factors that have led to the current state of affair (and isn’t it coincidence that such commentary largely emulates headlines across major publications) - real estate crisis, government crackdown, policy uncertainty, trade war or cold war, sluggish consumer demand, even hot war over Taiwan. However, when I look at some of the earnings from top companies in China, a much less pessimistic picture emerges. Consider this: of the largest ~240 listed Chinese companies by market cap, the aggregate revenue and net profit growth CAGR from 2019 to 2023 is c.8% and c.7% respectively, and that 90% and 80% of these companies demonstrated positive growth CAGR in revenue and net profit respectively since 2019. In fact, many of the household names across various industries show consistently high revenue CAGR growth over the past 4 years despite such ‘tough’ macro environment - Tencent (13%), Alibaba (17%), Moutai (15%), Anta (16%), BYD (47%), Nongfu Spring (15%), China Merchant Bank (9%), Haidilao (12%). Of course the past isn’t indicative of the future. Hence, there is some disconnect happening here - either the entire Chinese economy is heading towards a prolonged and deep recession or this is the set-up of an attractive value-price mismatch (think the likes of GFC in 2008). I don’t dispute that the Chinese economy is currently undergoing some tough challenges on many fronts as the government is working to re-engineer the economy away from the reliance of infrastructure and real estate growth towards consumption and tech self-reliance, but to think that the economy and companies are all headed towards disaster (as the valuation suggests) appears to me as fearmongering.

Here is my bold (and obviously biased) prediction: I believe that there are sectors and companies within the Chinese investable universe that currently present excellent risk-reward ratio, induced by the aforementioned disconnect and ‘broad-stroke’ fleeing of capital without regard to individual company fundamentals. If I were to guess on the reasons for such a disconnect, it would be due to the lack of understanding of the Chinese market environment by many investors (particularly the West) and the herd mentality at play.

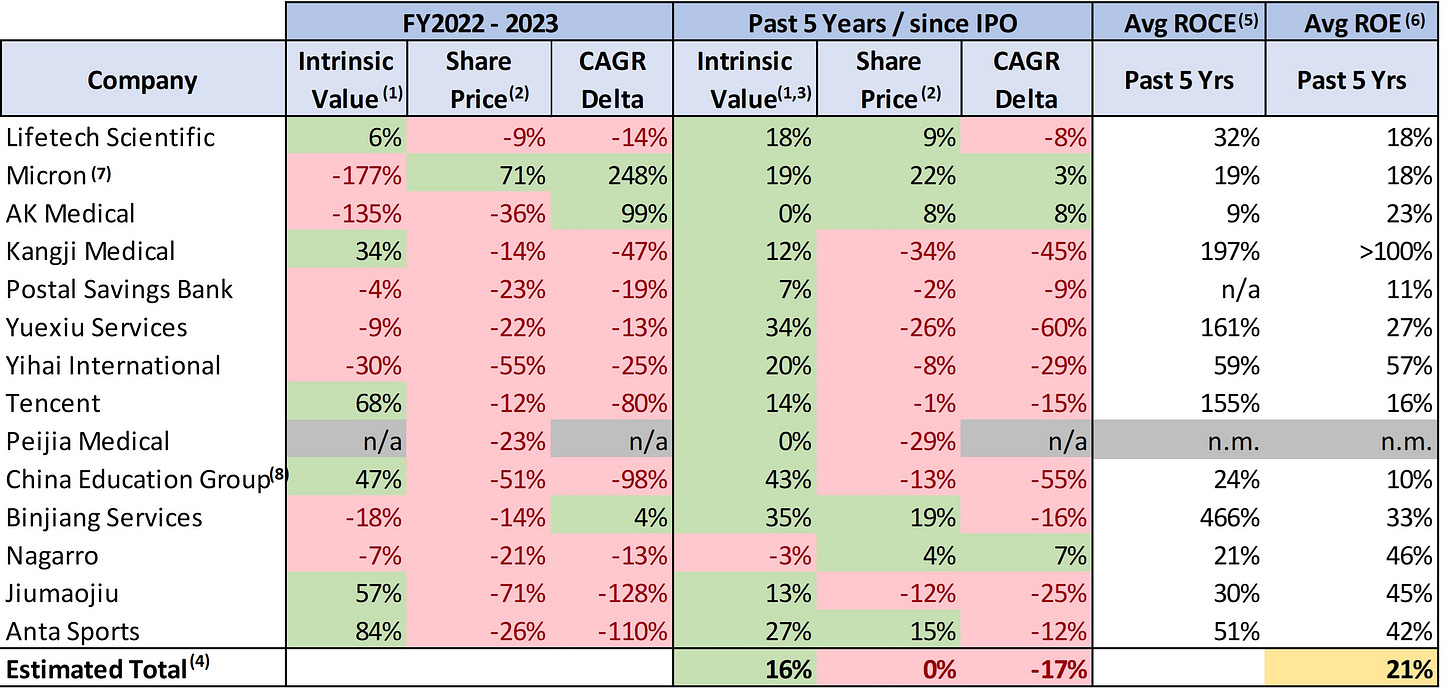

This brings me back to the core tenet of value investing, as Ben Graham has famously said: “In the short run, the market is a voting machine but in the long run, it is a weighing machine”. If we can find companies in China that continue to widen their moats and execute on its growth strategy, sooner or later the market will feel the weight of its earnings and cash generated. Data speaks a thousand words, the table below shows the growth in intrinsic value (as determined approximately by the Buffett’s definition of owner earnings per share) vs. share price over the past 5 years, or since the stock’s IPO, whichever is later (Note: this table is prepared with Q1 2024 in mind, with some changes in the portfolio, and this is the reason to wait for the full 2023 result release).

Notes: (1) Intrinsic value is based on diluted owner earnings per share and approximated by (FCF - D&A or maintenance capex); (2) Based on closing share price of the last trading day between the two periods; (3) Based on the CAGR growth in owner earnings per share, for past 5 years or since year of IPO (whichever is later); (4) Weighted average based on portfolio weighting as at 31 Mar 2024; (5) Calculated as operating profit / total common equity (less excess cash only if the company is in net cash position); (6) Calculated as owner earnings / total capital employed (includes min. cash required to operate the business); (7) Micron’s ROCE and ROE are calculated on a rolling 5 year basis to smooth out the cyclicity of the industry, and its 5-year intrinsic value growth is approximated by the 5-year rolling ROCE; (8) China Education Group’s ROCE refers to levered capital employed (PP&E - debt) which is more applicable given the property nature of the business and high capex to build schools.

1.4 Billion Consumers

With such a backdrop in mind, over the past 12 months I have tried to find and study companies which display the following characteristics: (i) less susceptible to geopolitical risks (external shocks), (ii) less susceptible to CCP’s regulations (internal shocks), (iii) have high market share in China, (iv) demonstrate success in expanding beyond China, (v) have strong ROCE and reinvestment potential, and (vi) run by good management team. This led me to investing in companies operating in the consumer industry, whose business model is easily understood and hopefully within my circle of competence.

It is daunting to see how fiercely competitive China has become and whoever that survive and thrive in such a crucible will be a huge winner in China or even on a global scale. No matter what economic problems there are, there will always be 1.4 billion of consumers constantly looking to eat out, buy clothes, buy shoes, seek out entertainment, travel and play. On the whole, consumer confidence may have taken a hit due to the economic uncertainty and asset value depreciation. However, within the broad undercurrent, there is another countervailing trend of consumers opting to cut spending (“"消费降级”) and switch to more value-for-money local brands instead of foreign brands (“"国产替代”, think Anta instead of Nike, Xiaomi instead of Apple, BYD instead of BMW, Perfect Diary instead of Estee Lauder, on and on). Furthermore, because of the fall in property prices, people who otherwise would be saving up to afford the downpayment are now finding themselves with more disposable income to spend on non-property items such as food and travel. For the sharp eye readers, you would have noticed that I added two new consumer stocks to my portfolio - Anta Sports and Xtep International (and a couple more companies added in Q1 2024 which I will talk about in my next letter).

Portfolio Updates

Consumer: Anta Sports (HK:2020) - For the year ending FY2023, Anta grew sales and diluted EPS by 16% and 33%. However, share price drop 26% from $102 to $75 during the same period. I took advantage of the disconnect and bought Anta shares in Dec 2023 at an average price of HK$ 73.4 per share (which I added more in Q1 24). As I research more into Anta, I can’t help but am constantly amazed by the strong management team led by Ding Shizhong and how customer-centric the company’s culture is. From my limited experience I have always observe that companies who obsess with delivering the best product to customers tend to always win over the long term against other product-driven or sales-driven companies. It is fascinating how Anta managed to win the race among domestic sports brands (most of which originated from a single county called Jinjiang (晋江) in Fujian Province) and how it eventually overtook Li Ning as the leading China sports brand. It has recently also overtaken Nike and Adidas in terms of overall sales in China. Over the past decade, Anta’s sales and net profit have compounded at a 24% CAGR, with an average ROCE (on owner's earnings) of 55%. To give a sense of the prowess of the management strategy and execution, the turnaround success of Fila is phenomenal. First originated from Italy, Fila China was acquired by Belle International (backed by Hillhouse Capital) for USD 48m in 2007. After 2 years of unsuccessful operations and a net loss of RMB 33m in 2008, Belle decided to sell Fila China to Anta for RMB 330m in Oct 2009. With the brilliance of product marketing and pioneering the sports fashion trend, Anta managed to grow the Fila brand to a sales of RMB 25bn and operating profit of RMB 6.9bn in 2023 (>20x the purchase price in 2009!). With the huge success of Fila and Amer Sports, Anta has set its sights on overseas expansion and I believe the snowball will continue to roll on.

Consumer: Xtep International (HK:1368) - after studying all the listed sports apparel makers and the industry evolution and competitive dynamics, I have decided on two companies to own - Anta and Xtep. Xtep was from the same county as Anta but started 10 years later in 2001. It has since managed to survive the fierce competition and the boom and bust industry cycle in 2012-2016. Since then, the company has carved out a strong niche and dominance in running shoes in China, with top marathon runners opting to endorse its brand and shoes. Although I very much prefer Anta than Xtep as a company, the valuation for Xtep was very attractive at the time of purchase (trading at 10x P/E with zero net debt). I was also attracted to the recent acquisition of Saucony China, K-Swiss and Palladium, which could provide a huge upside if they can grow well in China. This is one of those bets that Mohnish will term as ‘heads I win, tails I don’t lose much’ (P.S. I have sold this position to switch to Anta in Q1 2024, which I will talk about in my next letter).

Property Management Companies

Yuexiu Services (HK:6626) - For the year ending FY2023, Yuexiu Services grew sales and diluted EPS by 30% and 17% respectively. Contracted GFA and GFA under management grew by 18% and 26% respectively. The contracted-to-managed ratio continues to trend down from previous years of ~150% to ~130% in 2023, which I would consider to still be healthy considering the current real estate crisis. Average property management fee for residential properties remained stable at RMB 2.7/sqm/month, while that for office buildings and shopping malls registered a slight decline of ~5%, which is well within expectations. GP and operating margins in 2023 have remained stable now after the drop in 2022. Trade receivables continue to remain stable despite the cashflow issues faced by many in the industry. Property managemment is one of those boring and labour intensive industry where nothing much seems to be worth highlighting for Yuexiu Services (and Binjiang Services) as the company continues to march along year after year. The financials, however, has been nothing short of an eye-popping performance. For the past 5 years, sales and net profit after tax have grown at 33% and 61% p.a. (that’s a 10x in 5 years!). Contracted GFA and GFA under management have grown at 23% and 27% p.a. respectively, notably about 60% came from independent third parties not related to the parentco Yuexiu Group. Although I expect growth to slow down amidst the current tough environment, I am still confident of the management achieving its target of mid teens CAGR growth in earnings in the next 3-5 years. With a dividend payout ratio of 50% and the market cap as of Q4 2023 being lower than net cash balance (yes, the market thinks the business operations are worthless or that the cash doesn’t belong to the company), I can definitely sleep well owning Yuexiu Services (albeit with occasional frustration with the capital allocation strategy of the management sitting on a pile of idle cash). Obviously, this cries out for an aggressive share buyback program but I also understand it would be limited in scope due to the float and daily traded volume.

Binjiang Services (HK:3316) - For the year ending FY2023, Binjiang Services grew sales and diluted EPS by 42% and 20% respectively. Contracted GFA and GFA under management grew by 19% and 31% respectively. The contracted-to-managed ratio continues to trend down from previous years of ~180% to ~150% in 2023. Average property management fee for residential properties continues to hold up well and remains top among all the large property management firms at RMB 4.21/sqm/month vs. RMB 4.26/sqm/month last year, owing to its premium segment focus (industry average is ~2.0 to 2.5/sqm/month). GP and operating margins in 2023 declined by 4-5 ppt from 2022 as the Company started to grow aggressively into home furnishing services as part of value-added services to home-owners, which is a low margin business. On a longer time scale, over the past 8 years the Company has grown sales at 43% CAGR and net profit at 60% CAGR (that’s >40x increase in 8 years!). The company continues to expand beyond Hangzhou with high growth in cities such as Jiaxing, Shaoxing and Jinghua. Parent company Binjiang Properties remain one of the most stable private property developer in China, rising up the ranks with growing sales while maintaining relatively strong balance sheet. Trade receivable days remain stable. What is amazing for both companies is just how little capital was required to gush out such an immense amount of cash year in and year out. Indeed, the ROCE is off the charts and makes little sense. I believe well run property management companies with strong parentco balance sheet, track record of 3rd party contract wins, focus on Tier 1 and 2 cities, remain misunderstood by the wider market, which I am not shy to take advantage of.

Postal Savings Bank of China (HK:1658) - For the year ending FY2023, PSBC had a relatively flat year with revenue growing at 2.2% while net profit growing at 1.3%, owing to the overall macro environment, compressed net interest margins (decline from 2.2ppt to 2.0ppt in 2023) and less than expected growth in non-interest income. Net loans increase by 13% while total deposits increase by 10% (with a disproportionate amount being put into time deposts). ROE remained at ~10% in 2023. As usual, the bank continues to operate very conservatively and I believe its earning potentials and assets are not being fully utilized. Dividend yield is high at >7% as at end 2023.

Nagarro SE (XETRA:NA.9) - I first invested in Nagarro in Oct 2023 after trying to look for ex-China companies to have some diversification (I have yet found any Japanese stocks that met my criteria). My average price paid was EUR 74, translating to ~11x owner earnings. What caught my attention about Nagarro was its unique heritage (being spun out of its parentco Allgeier in Dec 2020), its small cap nature (EUR 1bn) with little coverage in an European stock exchange. As I dig deeper into the company, I am fascinated by its unique culture and organization structure - it has no traditional CXO roles whatsoever, no headquarters, company is led by a ~50 senior management team members from ~15 different nationalities. Despite having 50 office locations in 36 countries with >18,000 employees, the company is organized around a virtual global organizational model that deprecates country organizations, with the primary dimension being that of the global business units or GBUs. A key role within the company, called Project Leaders, have freedom over everything from their clientele to their investment strategy without the interference of the management team. The end goal of such an innovative model is to achieve an organisation that is client-centric, entrepreneural, agile and non-hierarchical. In the IT outsourcing industry, the employee turnover ratio is usually pretty high, and the key differentiation is people and talent retention. Hence, the moat of any company competing in this industry will be the culture that enables the company to attract and retain the best IT talents. Even though I still have doubts on whether this can work well in the long run (smart humans are inherently difficult to organized in a big group), the audacity and will of the CEO Manas Human to even try out such an organizational design is laudable. On operating metrics, for the year ended 2023, Nagarro grew sales by 7% in 2023 but net profit declined by 33% as clients cut down IT spending across the industries. Over the past 5 years, revenue and net profit grew at 26% and 45% CAGR respectively, with average ROCE (owner earnings) of 21%. I believe that IT outsourcing and digital transformation are here to stay despite the threat of AI and democratization of software programming. The company should be able to weather this current temporary turbulence well, and continue to gain market share in this growing industry.

Kangji Medical (HK:9997) - For the year ended 2023, Kangji Medical grew sales by 18% and net profit by 5%. Net profit would grown in line with sales, if not for the losses contributed by the surgical robotics subsidiary Weijing Medical (which will be de-consolidated from the accounts starting in FY2024 as the Company wants to give more autonomy to the management team of Weijing given that Kangji is only a 35% shareholder). Despite the fear of Jicai impacting its sales and Kangji’s product concentration on minimally invasive surgical instrument and accessories (MISIA) products, so far there is no nation-wide Jicai on its core products. Company has managed to navigate the provincial Jicai relatively well given the inherently high margins, flexibility to go direct without distributors or 跟台人员 and strong market share among domestic players. For the past 5 years, Kangji has grown sales by 21% and net profit by 18%, with an estimated average ROCE of >100%. Its GP margins consistently hover above 80% with net margins at 60%. After raising RMB 2.9bn in a IPO in Jul 2020, the Company struggles to deploy the capital as the operations continue to generate free cashflow in excess of RMB 1bn over last 3 years, which it has used to pay dividends and buyback shares in addition to capex and investments. Currently, the Company still sits on a cash pile of RMB 3.0bn at the end of FY2023. However, in another sign that the management team is shareholder friendly, the Company has declared a final dividend of RMB 0.41 per share, and a special dividend of RMB 0.99 per share. In totality, this represents a cash payout of RMB 1.7bn or ~22% of total market cap as of end Dec 2023, and Kangji would still have well over RMB 1.3bn in the coffer (with annual FCF generation of RMB 400mn). Though it all sounds bright and sunny, in my view Kangji’s problem lies in its future pipeline products and its ability to find the next growth drivers other than disposable trocars and ligation clips. I shall continue to monitor its progress on this front and update in due course.

Lifetech Scientific (HK:1302) - I have owned Lifetech the longest time among my existing portfolio companies, and have tracked its progress for more than 5 years now. Fundamental clinical-driven R&D and global expansion are the dual strategies which the management team continues to execute and progress steadily. Over the past few years the company has been ‘cooking up’ some major product pipelines currently in late stage clinical trials - a few major ones will be IBS iron-based bioresorbable scaffold, G-branched Thoracoabdominal Artery Stent Graft System, Aortic Arch Stent Graft System, etc. In the next 2 years these products will be commercialized and start contributing to the earnings. For the year ended 2023, Lifetech’s sales grew by 15% while adjusted operating profit declined by 12% as the Company ramped up spending in R&D and higher expenses due to share-based payment expenses associated with the Biotyx Medical (excluding impact of Biotyx Medical will result in flat operating profit). Over the past 14 years, Lifetech’s sales and operating profit have compounded at 22-23% p.a., and ROCE (owner earnings) have averaged ~30%. Such performance for this extended period of time usually means some kind of a moat, which I believe is the continuous emphasis on truely innovative products from clinical-driven R&D programs. Although the competition has become more fierce in the MedTech space (e.g., many other LAA occlusion devices have sprung up) and the impact of centralized procurement on the industry, Lifetech has managed to hold up relatively well compared to other MedTech listed peers. Nevertheless, I believe the market has underappreciated the pipeline products and the overseas expansion potential.

I shall continue with FY2023 update on other portfolio companies (Micron, AK Medical, Peijia Medical, Yihai International, Jiumaojiu, China Education Group) in my next Q1 2024 letter. Please stay tuned…

As always, thank you for your attention and any comments are welcomed.